Mint: A Comprehensive Review

It’s really hard to keep track of all your finances in modern society. Luckily, there are many apps which serve exactly that purpose and have the potential to make our lives easier. One of the freshest ones (pun intended) is Mint.

This award-winning finance software has revolutionized financial budgeting. Thanks to it, you can manage your finances on your own without paying your bank or any financial advisors to do it for you.

The best thing about Mint is that you can download and use it for free on your computer and iOS or Android smartphones and tablets.

Mint: Getting Started

You can start using Mint right away. All you need is a computer with an internet connection. Go ahead and visit mint.com, click on Sign up and create an account. Alternatively, you can download the Mint app on your device from the official App Store or Google Play Store.

Registration is free across all devices, and so is the use. Mint is ad-supported and not suited for business use. It is designed as a personal finance tracker for people who would like to take care of their personal budget.

You can use the app to track your expenses and keep them in check. You will realize how useful when you start using the app.

It’s easy to use as well, as the user interface is simple and neatly organized. Even beginners will be able to find their footing soon enough, thanks to the initial tour of features upon account creation. You will then have to supply the info of your financial accounts.

Mint Profile Setup

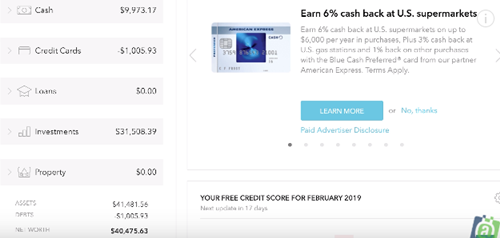

It is up to you to decide how much of your financial info to link with Mint. The best way to use it is to link all of your accounts so you get a clear picture of everything. You can also add your major assets like your car, home, etc.

You can click on Profile in the toolbar and fill in your demographic and contact info. In the Settings menu, you will find the links to all your accounts. Click on Notifications and set them up accordingly. You can get notification emails for bills that are due, credit score fluctuations, and low account balances.

As soon as you set up everything, you will be able to inspect your spending habits from the past few months. It might help you understand your financial standing, income, spending trends, etc.

Mint Features Review

There are many great features on Mint, which are all transparent and easy to use. Here are some of the most notable:

Budget Advice

Since Mint gathers all of your spending habits, it can help you establish your personal budget. You can adjust the budget as you wish, and Mint will notify you whenever you exceed something. Unfortunately, these budget plans are monthly, so you will have to make a new one for each month.

Track Your Expenses

This feature is closely connected to the previous. With Mint, all transactions can be neatly organized into categories. You can create your own categories and the rules for them. If you happen to spend too much, or if there is any unusual activity (irregular large sums deducted, for example), you will be notified.

Personalized Goals for Saving Money

Everyone spends and saves their money in their own fashion. Mint will help you determine your goals for saving money. Specify the amount that you want to save and the account to use for the savings. Mint will then inform you of the necessary monthly contribution to said account.

This feature is still in need of some polishing because you can only set one saving goal per Mint account. Also, if you already have some money in the account, Mint may mistake it for the money that you plan to save.

Track Your Bills and Credit Score

You can also track your bills in Mint, manually or automatically. Mint also lets you set reminders for due bills so you never miss a payment again. You can also check your credit score in Mint.

Manage Your Assets

As mentioned before, you can add your other property to your Mint account, not just financial accounts. Add your valuable assets such as vehicles, houses, jewellery, and more. Mint is linked to Kelly Bluebook, so it will show the value of your car according to Kelly.

Manage Your Investments

Last but not least, you can connect all of your investment and retirement accounts within Mint. If you don’t have them, you can set up new ones with Mint.

Hint at Mint

Mint is an amazing financial software, especially because it is free and so easy to use. It doesn’t offer much customer support, but most people don’t need it because of the program’s ease of use. The iPhone and Android apps work great, but unfortunately, the Kindle app has been discontinued.

Which aspects of Mint do you like the most? Did it help you get a better insight or control over your finances? Let us know in the comments section below.