TechJunkie Expert Recommendations

Life is full of stressors, and one thing that everyone seems to stress about is money. Personal finance is something that is not often taught in schools, and as a result, many people grow up without any idea about personal finance topics like saving, investing, budgeting, and more. Even for those with a bit of education and knowledge about personal finance, money is still a stressful topic. You can always worry more about the future and whether you are doing things right.

Thankfully, there are many apps out there that can make finance easier, quicker, and more streamlined for everyone. We can use iPhone apps for almost everything now, from journaling to dating to exercising. With how quickly technology is evolving, our phones can do more than ever when it comes to helping us with our personal finance goals. Whether your mission is to save money, invest more intelligently, track your money, budget better, or simply become more educated, there are many apps out there that can assist in a big way. This article will go over some of the best tools you can use to get a hold of your finances using just your iPhone.

While some these apps can be a tad overwhelming when you first begin with them, that feeling will soon dissipate and you will be thankful you took control of your finances. Some of the apps you are about to learn about will cover various different aspects of finance, while others will zero in on one. However, all of the apps on this list are among the best personal finance apps out there and they are all worthy of a download.

Compatible With

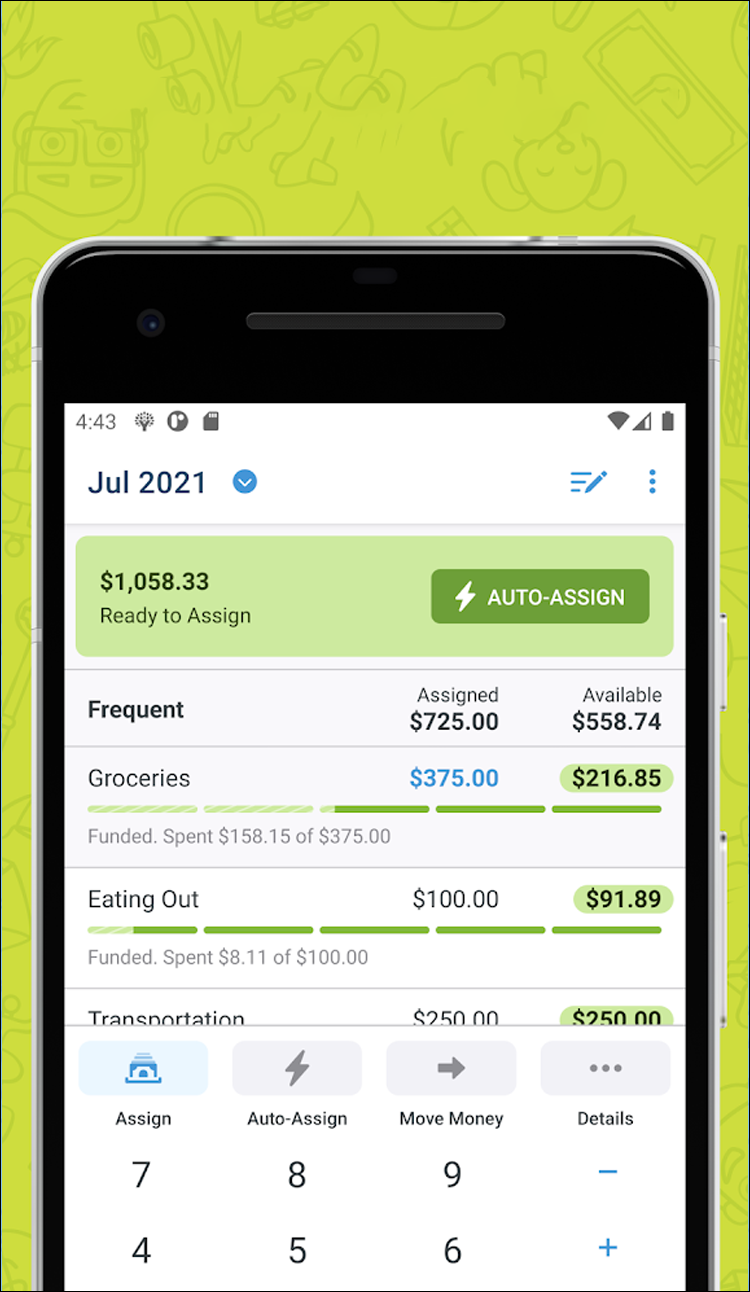

Out of the many different personal finance apps out there, I believe YNAB is the best. YNAB stands for “You Need A Budget,” and this app not only helps you budget your money better, but can also educate you more about personal finance itself. The program has been around for over a decade and the app first released in 2010. Millions of people use this program to budget better and understand their money, and this mobile app helps you do that on the go. It’s become one of the most popular budgeting programs on the planet.

YNAB has been around since 2004 and has gone through a number of different updates. This current app will only work for the new YNAB version, which released in 2015. When you first download the app (for free, might I add) you are given a free 34-day trial to test out the full features of the program, with no credit card required. If you decide it is not for you, simply delete the program and app and move on with your life. However, if you decide you like it and want to continue using it, you can subscribe for $5 a month. While some of the apps in this article are free, $5 is still a very small price to pay for the kind of features, content, and tools you get with this program and app.

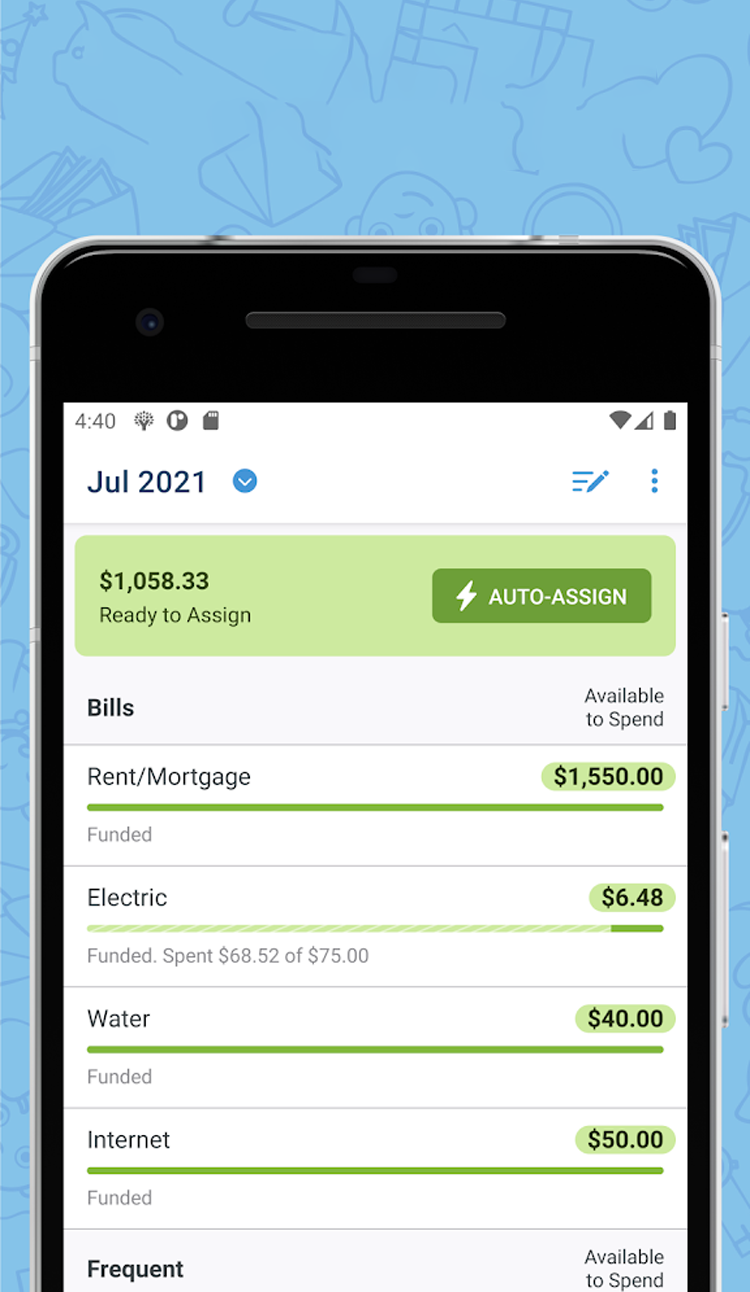

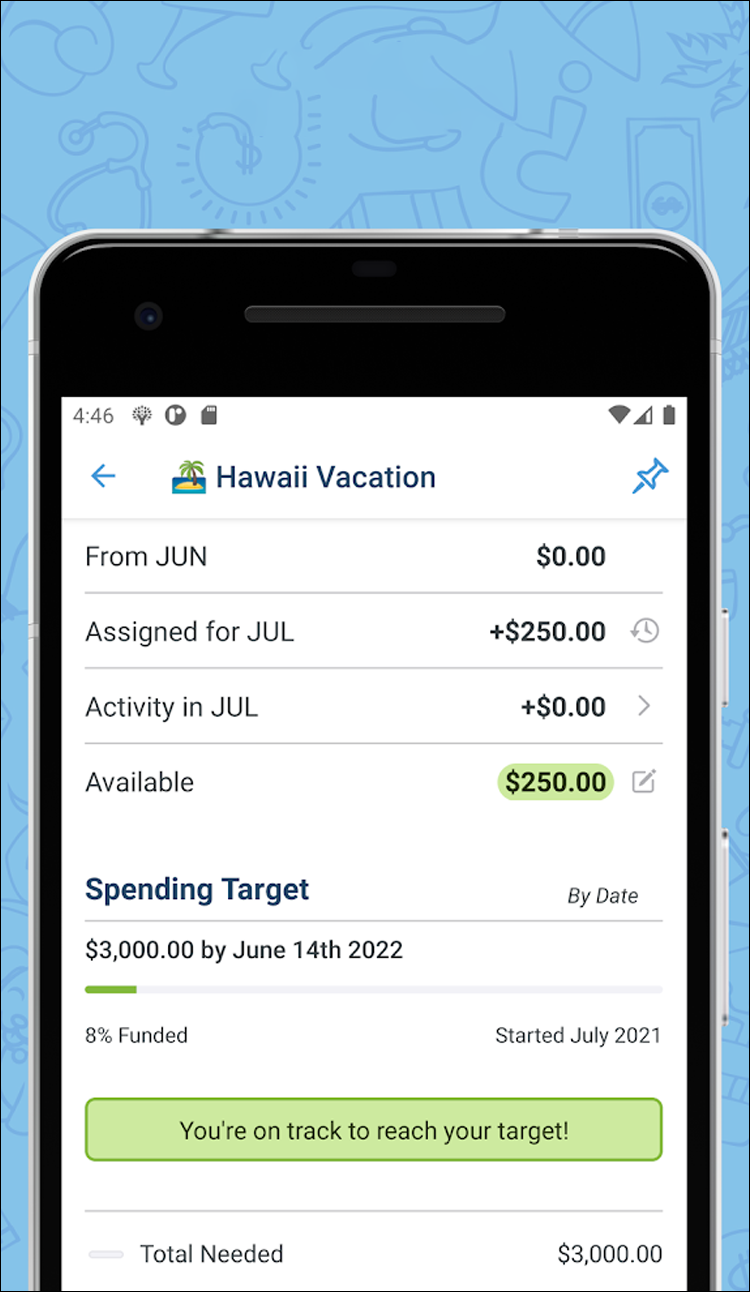

YNAB is a multi-platform budgeting and personal finance program based on the envelope method. The envelope method is an effective tool for visualizing a budget, that basically means you break down your expenses by categories to help identify where your money is going. While YNAB is a budgeting software, it is perhaps best understood as a budgeting system with software to support it. YNAB as a budgeting system focuses on four different rules, which are:

However, even if you deviate a bit from these rules, this app can still help you big time in understanding your finances and budgeting more intelligently. But those steps are worth a try as they do teach you some good things about finance and getting the most out of your money.

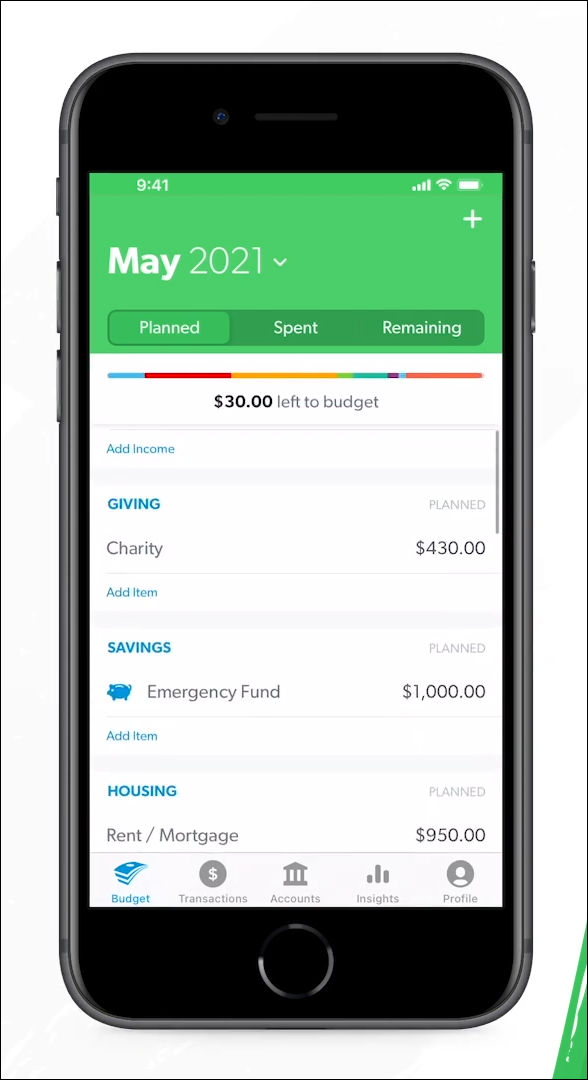

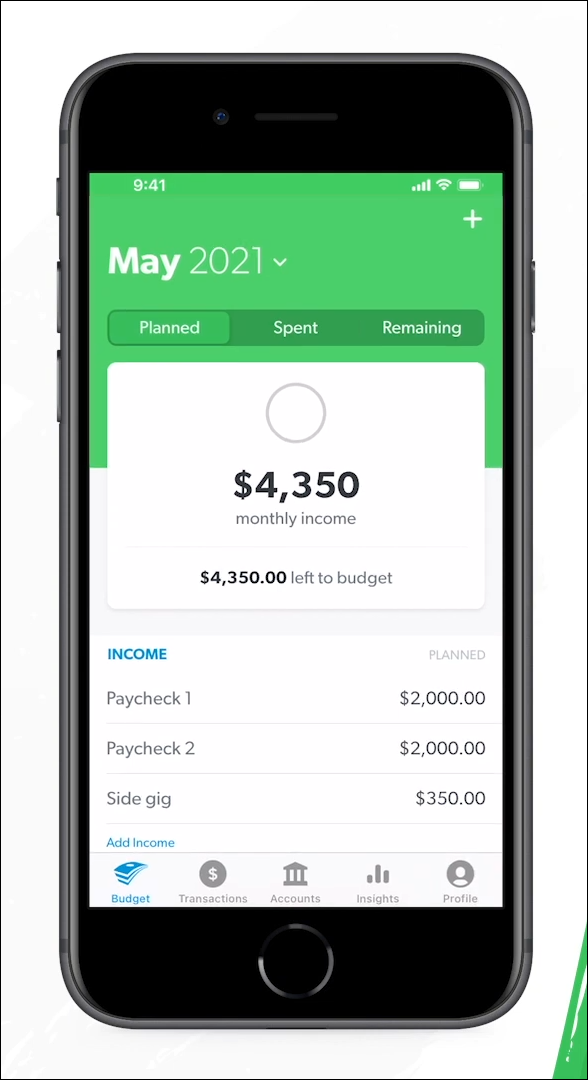

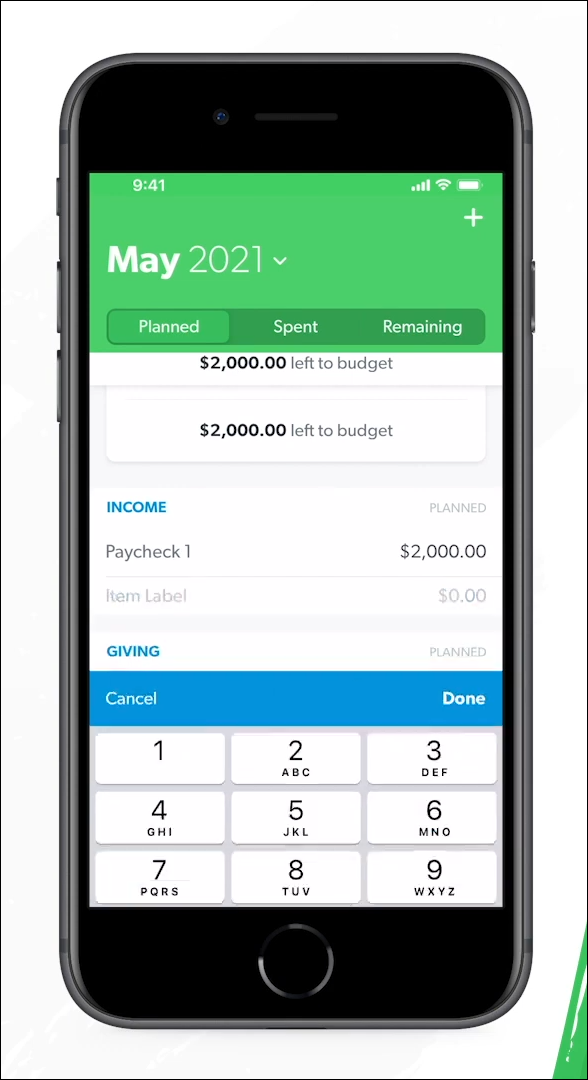

So now that you know a bit about the budgeting system that YNAB uses, let’s take a closer look at the software itself. That software is what you will interact with on a daily basis with this app. Whether you make changes on the desktop program or the app, the changes will instantly carry over so you can budget from the comfort of your own home or on the road. That is extremely helpful when you want to update purchases and transactions right away.

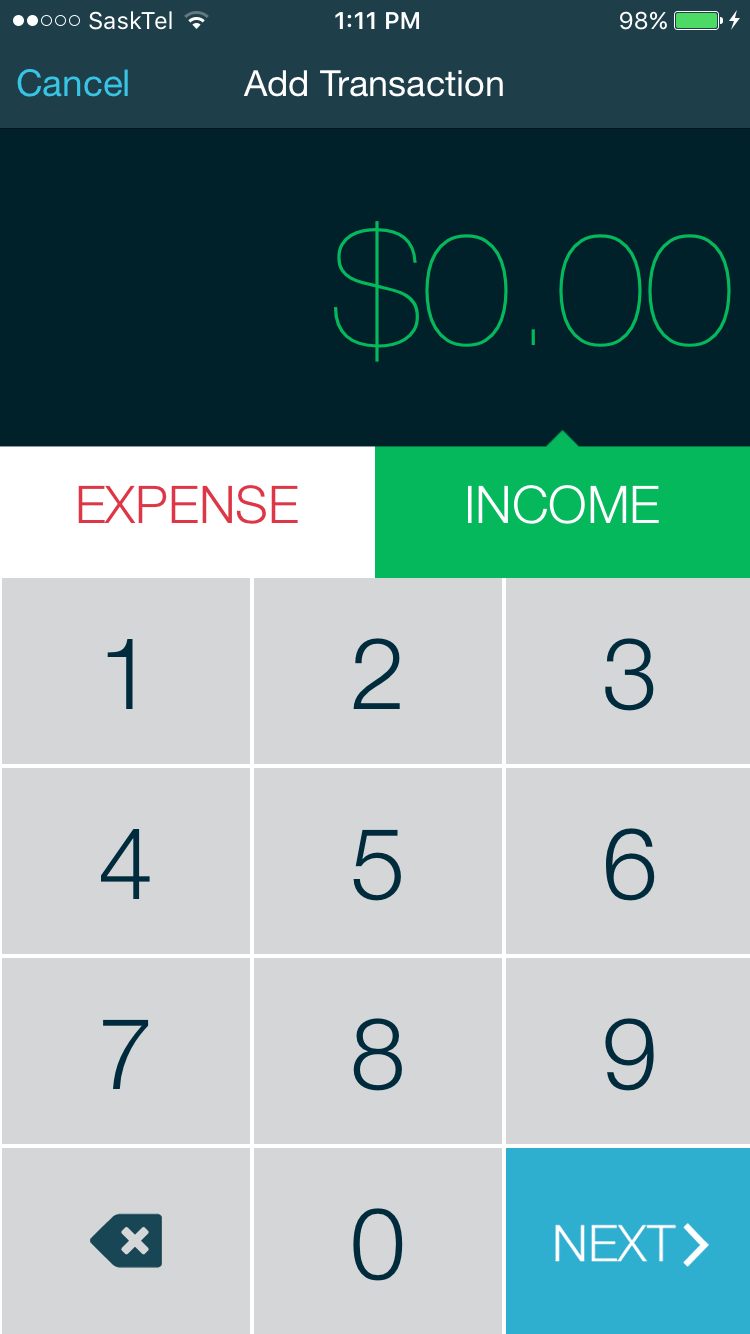

When it comes to budgeting, simplicity is of the utmost importance. Thankfully, when you start up this program, it takes you through a tutorial that makes it fairly easy to find your way around the app. However, even with the tutorials, it will take a bit of time to get proficient with the app. This program makes it extremely easy to create expense categories and makes it even easier to enter transactions into those categories. The app starts you out with a ton of different categories that should cover all of your bases and even breaks them down between immediate obligations, “just for fun,” and other useful sections.

In addition to this, you can easily move money between categories in case you need a little bit more in one and a little bit less in another. For example, if you are out with your friends and have no money left in your “dining out” category, but a surplus in your “clothing” category, you can easily transfer some over without your budget becoming confusing. This can help in a big way, as this transfer is recorded. If you just did your budget with a pen and paper, you might miss this little transaction, which would leave you very confused about where that missing money went.

This app and program has two different ways of keeping track of your accounts. You can connect your bank accounts automatically to the app to keep track of them (similar to Mint) or you can do it by hand, which is likely safer (but more time consuming). There is always a bit of risk involved when you provide a third party app or program with your bank login credentials.

In addition to their mega-popular budgeting system, YNAB also helps you become more educated in the area of personal finance. They offer a ton of written and video guides on everything from how to deal with debt, to how to focus on and reach your goals. There is also a very helpful YNAB blog and forum, which are both full of great resources to check out to get better in touch with your finances.

While many of the apps on this list are “one-stop shops” for all your financing needs, that is not the case with YNAB. This is an app truly designed to get you control over your money and become better at budgeting. While some may find that is a negative, I think it’s a huge positive. YNAB knew what they wanted to do, and they succeeded at doing it extremely well.

If that’s what you need, this app fits the bill excellently. If you are looking for a budgeting app at an affordable price with every budgeting feature you could ever want, this app and program is for you. The app is especially helpful for those who live paycheck to paycheck and need help learning to budget.

Compatible With

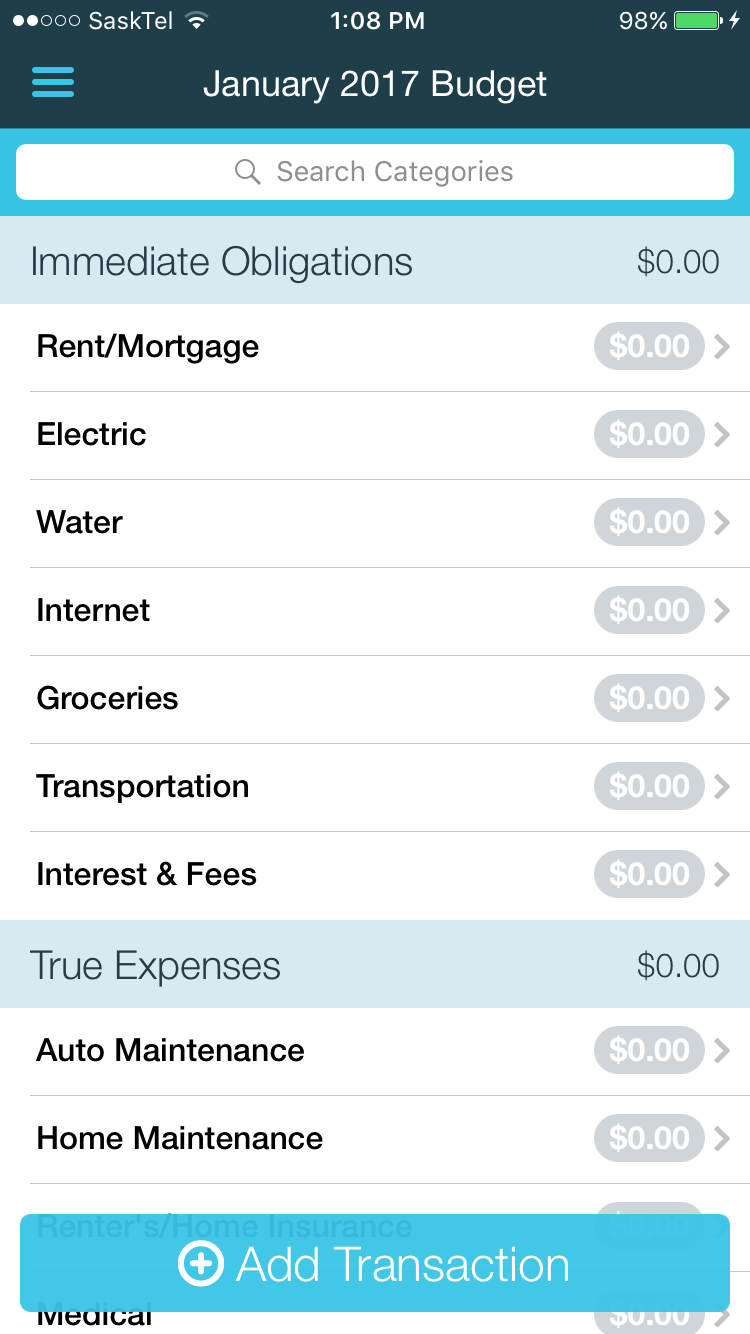

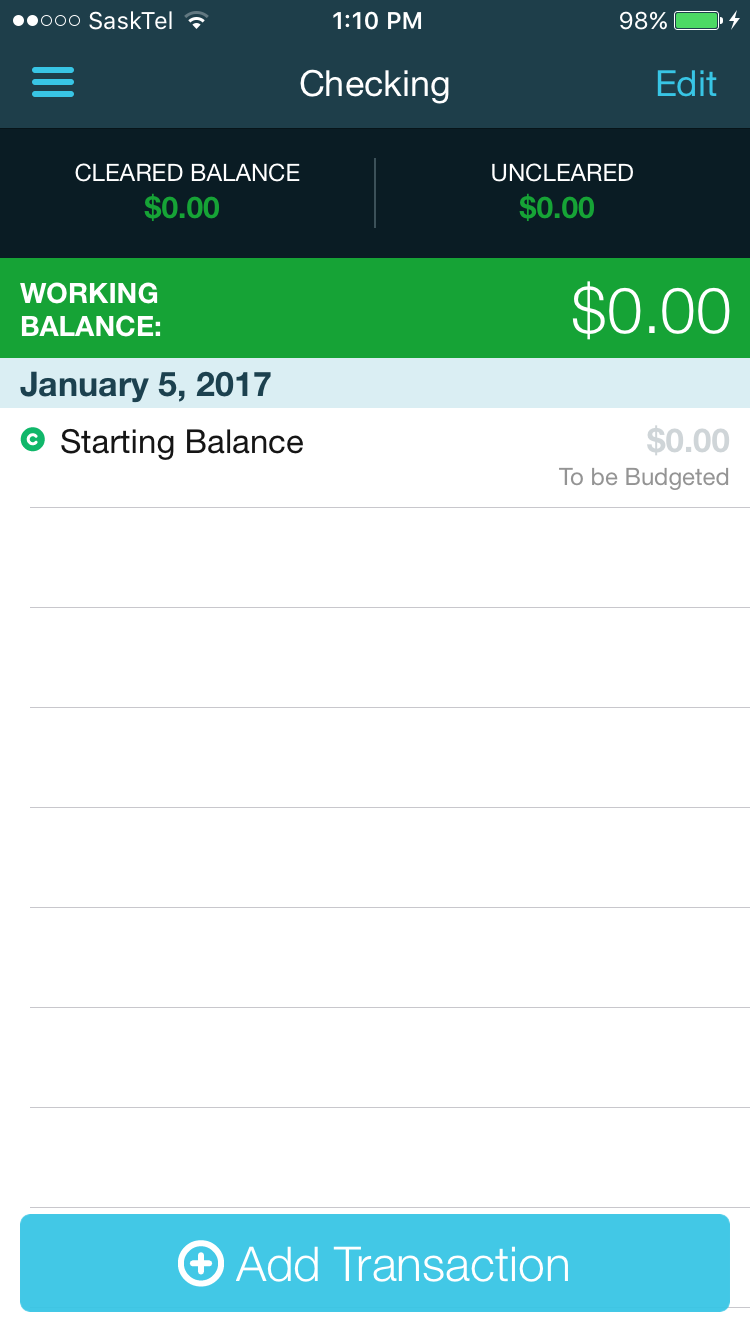

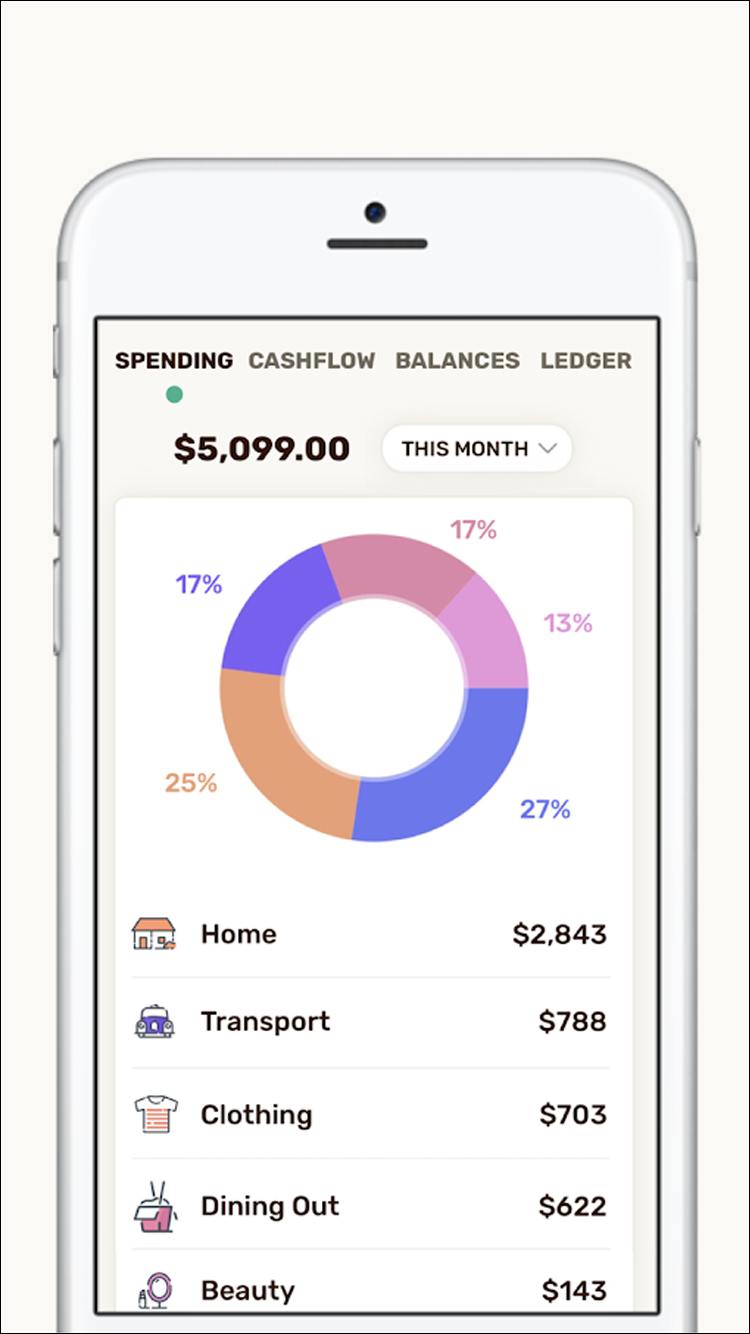

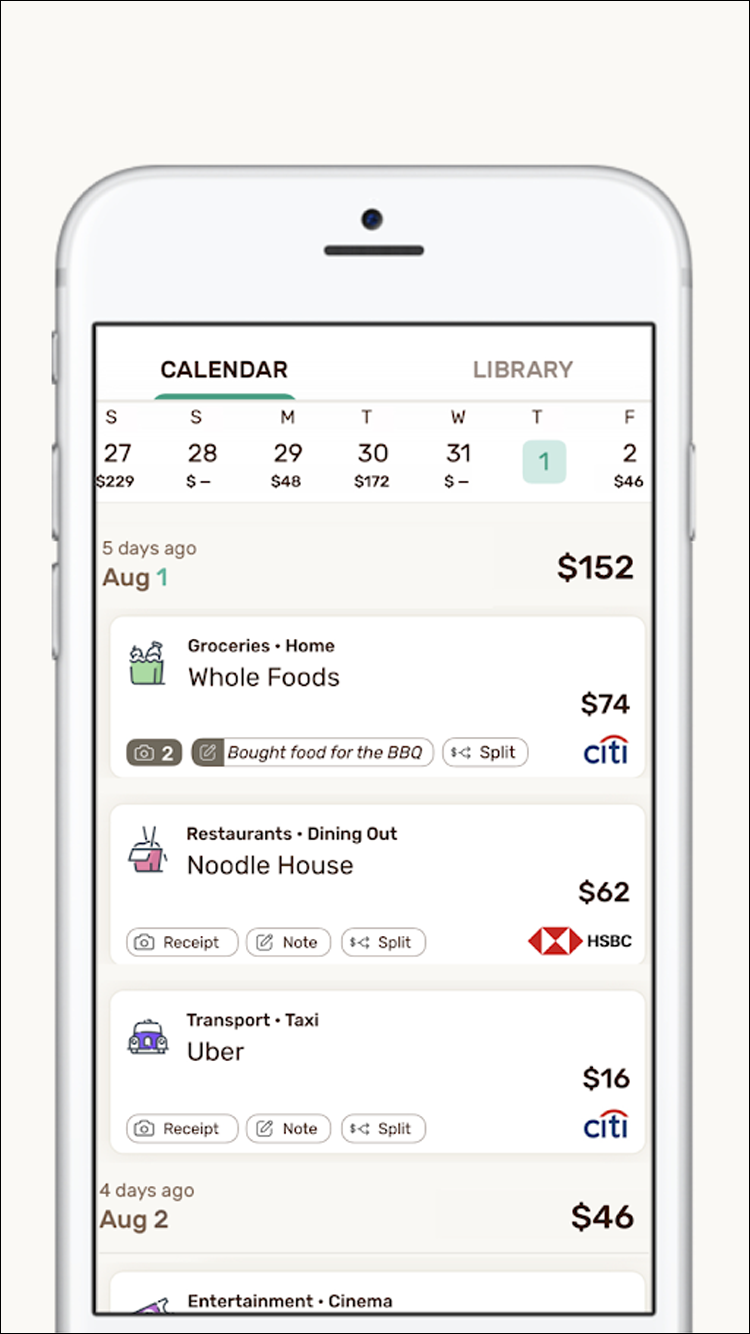

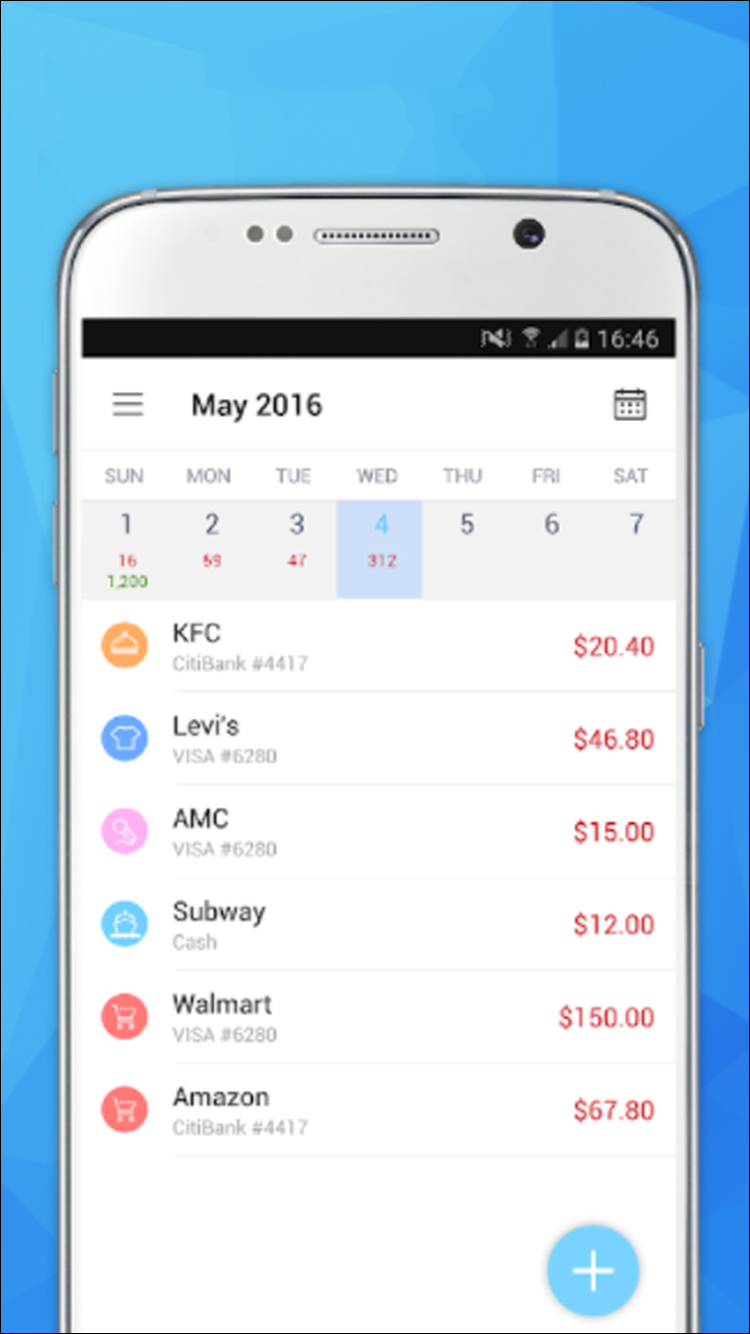

This selection come as a surprise to some, but for people just starting out with budgeting and getting control of their money, simplicity is key. With that in mind, I have chosen Wally as the runner-up in this battle of the personal finance apps. Wally is an app that lets you get in control of your money by balancing your income and expenses, understand where your money goes, and set goals and budgets in an easy, seamless manner. Perhaps best of all, the app is completely free to use.

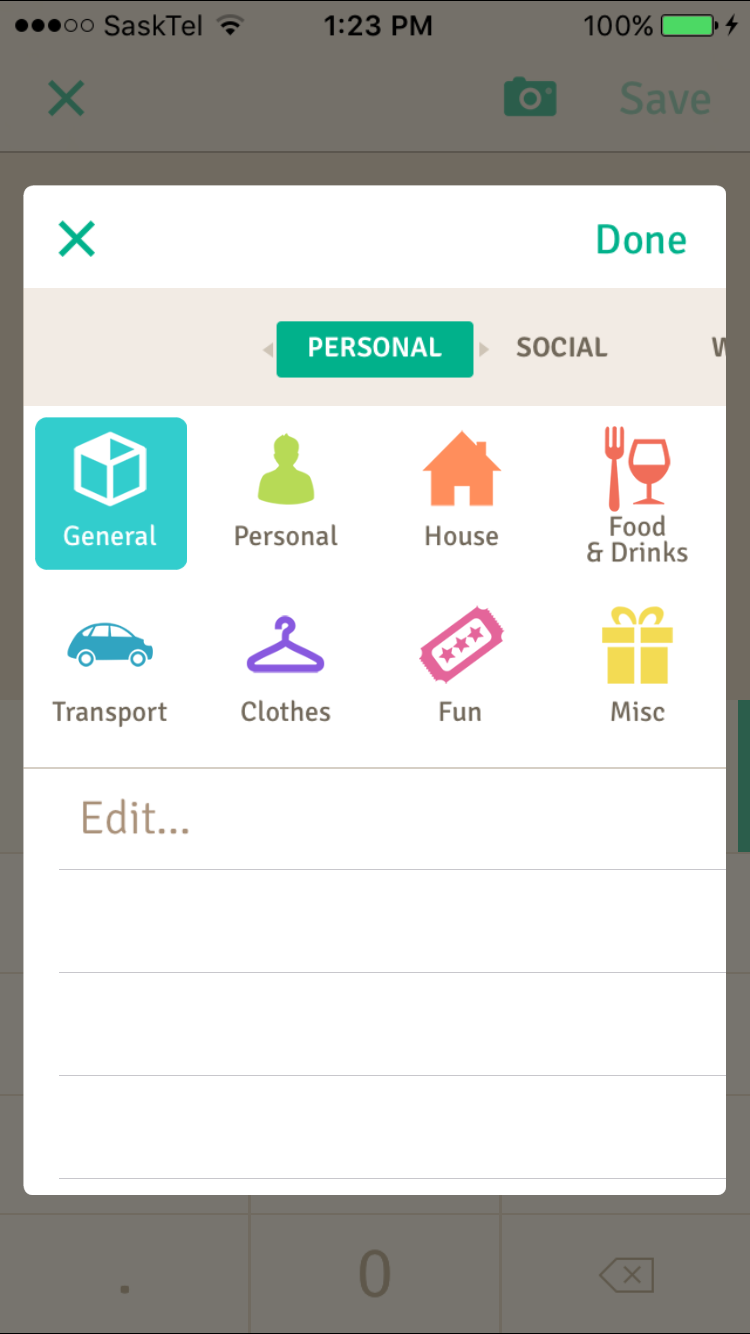

When you first download the free app and fire it up for the first time, you will see three main tabs on the side of the screen: Home, Income, and Review. The Home tab is where you enter your expenses. There are a number of different expense categories that you can choose from, including transportation, entertainment, clothes, and more. You can also create your own categories. Every time you enter an expense, the app will try to guess where you are on a map to connect the expense to the place you bought it, which is a cool feature.

The Income tab is where you add up all the money you make in a given month. This allows you to set your savings goal. There is a bit of a learning curve when it comes to using this app, and this page is a testament to that. However, after a little bit of tinkering with it, it will become very easy. A bit of a learning curve (especially for those just getting started in personal finance) is normal to expect out of a personal finance app.

The last and final tab is the Review tab. This page will show you a basic review and analysis of your spending in the various different categories. You can look at this by week, by month, or by year.

Perhaps the most useful and unique feature on this app is “smart scan,” which lets you simply scan a receipt from a store, and the app takes data from it and enters it. This is much quicker than entering each expense individually. Another great thing about this app is its security. The app doesn’t store any data on its servers, which means you never have to worry about your information being at risk.

Unlike other apps, Wally doesn’t have the option to connect directly to your actual financial accounts, which some may not like. However, as I mentioned in the YNAB section, I don’t mind that it’s not included as a feature; there are always security concerns when you give your bank information to a third party.

There are those out there who will really like this app and those who won’t. While manually adding transactions and other information into the app, you can rest assured that your personal details have not been shared. Entering all the transactions yourself will likely help keep you more dedicated to saving and budgeting as it forces you to open the app and look at your budget every day.

The people who won’t like this app are those who want a more in-depth app that connects to your bank accounts for free, or finance veterans who want more options. However, someone who is just starting out will appreciate the app’s clean layout and the fact it stays basic while still being a great tool for those interested in getting control of their finances. While the app may take some getting used to early on, once you figure it out it’s among the best and simplest ways to control your finances from your mobile device.

Compatible With

In just a few minutes, this app can help you create a monthly budget with ease. EveryDollar uses the zero-based budgeting method, meaning it starts with everything at zero and each section or category in your life is analyzed. From there, it creates budgets for each part. So when you start the app up, you can complete a monthly budget in only minutes, and easily change it from month to month.

While the app isn’t incredibly complex, there is en elegance about it. Whether you are a newcomer or a budgeting and finance veteran, you will appreciate the simplicity. The whole app and system itself is based off of the award-winning Dave Ramsey, who has helped millions get better with their finances.

The app itself is free, but there is also a premium membership that can be purchased. You get a free trial for a month, but after the free trial, EveryDollar Plus will cost you $9.99 a month, and all you get beyond the free version is the ability to link to your bank accounts and call a customer service rep. The free app is great, but the subscription to Plus is fairly expensive for what you get out of it.

Compatible With

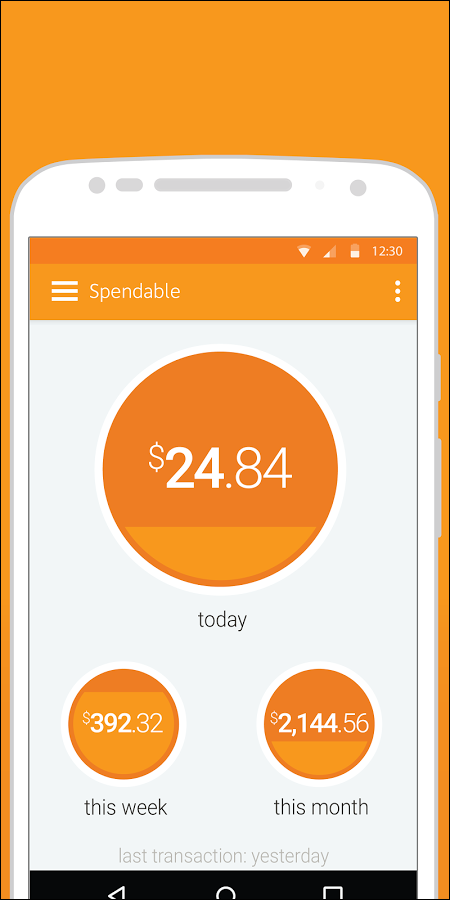

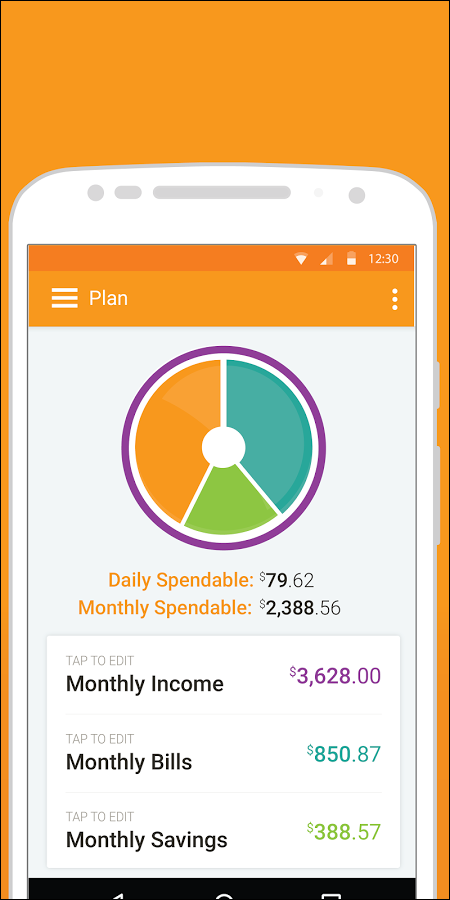

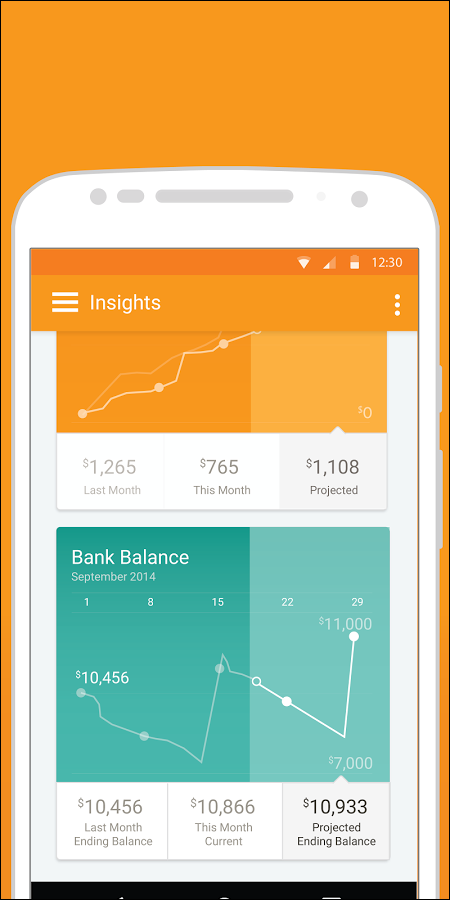

Level Money is an amazing app that can automatically analyze your financial picture with ease. This app is powered by Capital One, and over a million people use and trust it to track their money.

This app is great when it comes to showing your spending, which is one of the biggest problems for people when it comes to saving money. Level Money makes crafting a spending guide easy. You can also create your own spending trackers to make sure you’re not overspending.

Like a few of the others in this article, this app lets you connect to your bank account and credit card account, which also makes it simple to keep on top of your spending. If spending is your big issue and you want to see it in a very clear and easy-to-understand picture, this app will help save you some heartache and some money.

Compatible With

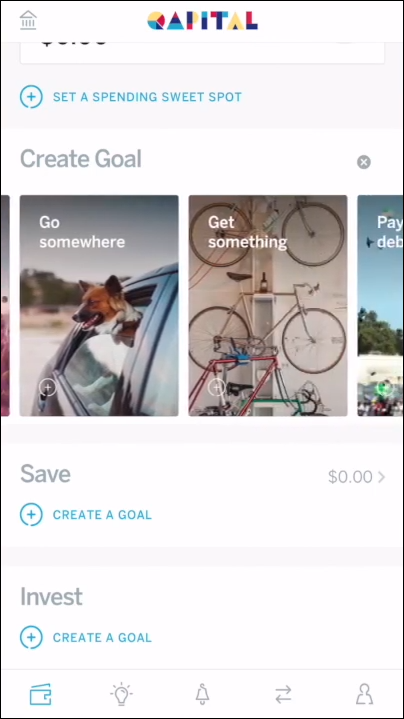

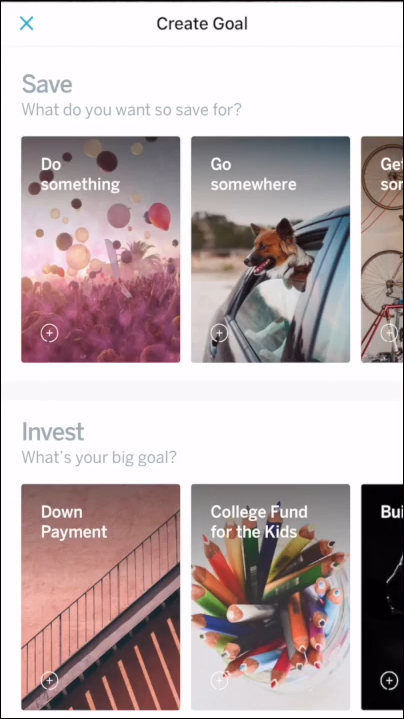

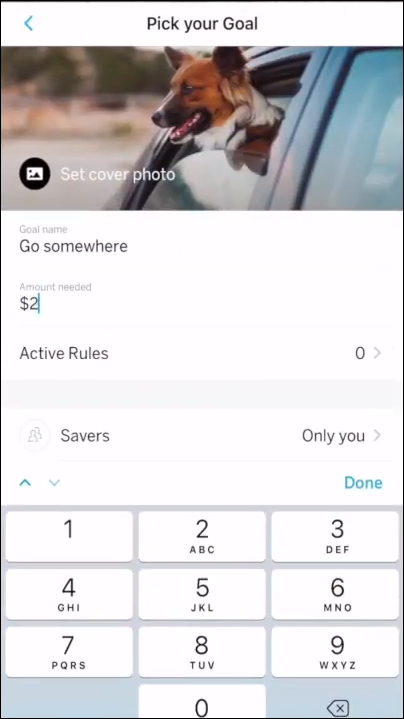

Qapital is a fairly unique app that makes saving money automatic. The app uses the ways that you are already spending your money to trigger small micro-savings, which the app puts aside for your goals. Whether your goals are saving for a trip, a new car, or a house, this app will be in your corner.

It only takes a few minutes to set up your FDIC-insured account on this app. The way it works is that you attach “rules” to what happens when you spend on a guilty pleasure. For example, you can make a rule where, each time you go for beers, a few dollars will be charged from your account and go toward one of your goals.

If you hate manually setting aside money for savings, this app is a great way to automate your savings to try and reach your goals.

Compatible With

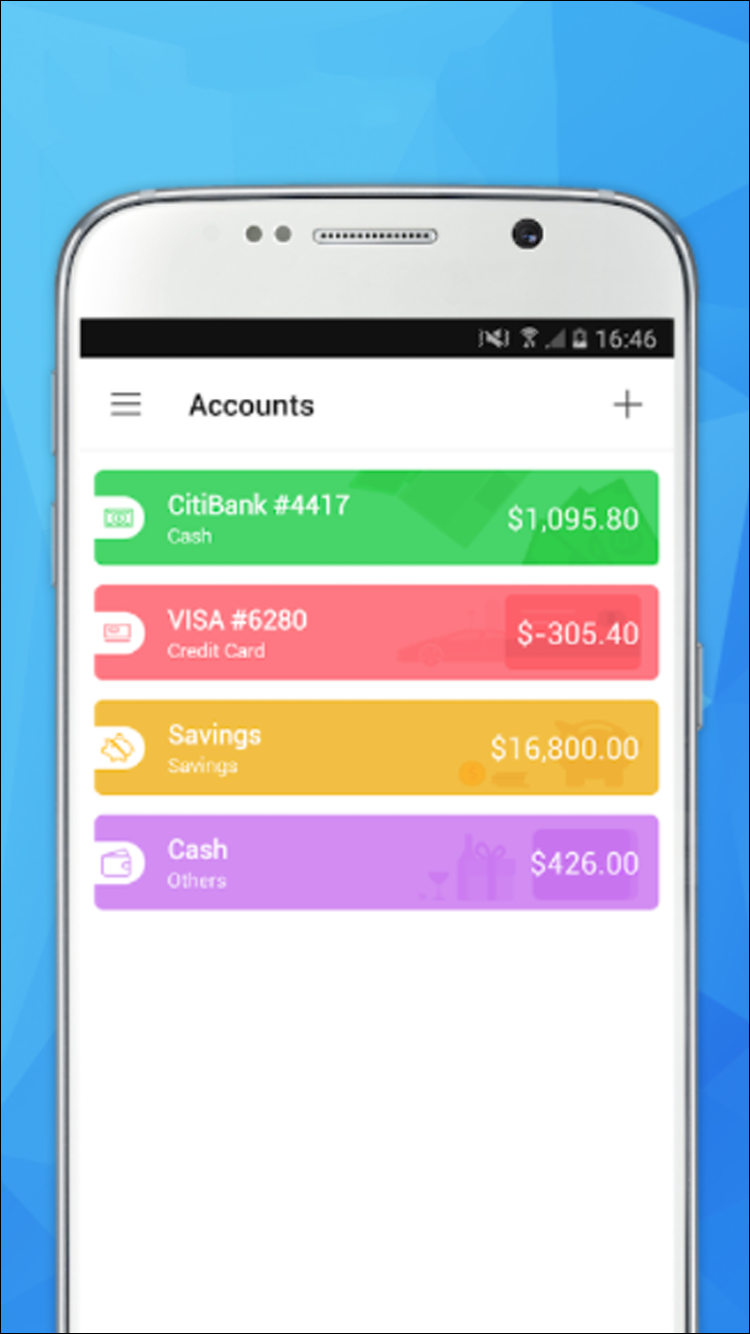

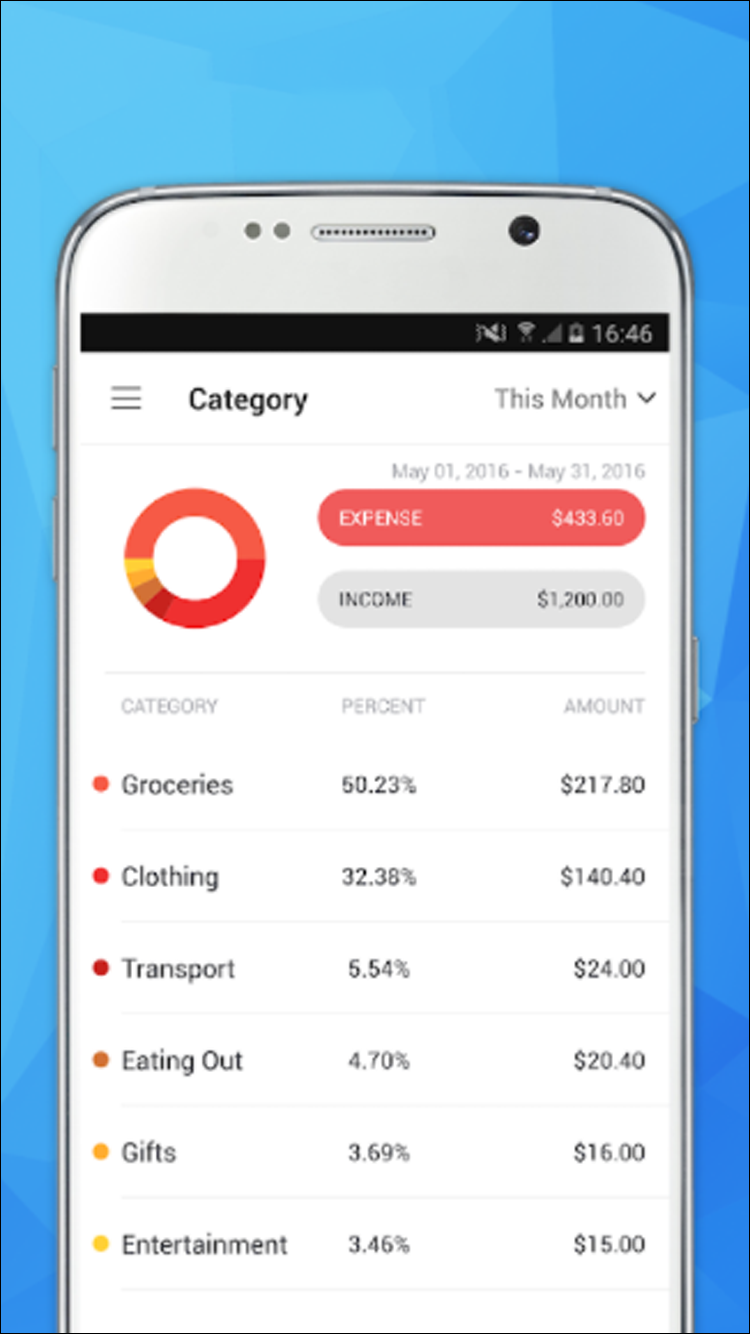

Pocket Expense is a full-featured piece of finance software that app helps you track and manage all your personal finance needs. It also helps you understand your finances better. This app brings all of your accounts together, keeps track of your bills, and lets you set budgets. Everything is put together in one place, making the app quite easy to use and navigate. Whether you want to see your credit card accounts, investment accounts, savings accounts, checking, or other accounts, this app is perfect for you.

Basically, this app is a jack of all trades when it comes to finance. It does a little bit of everything, without getting too crazy into anything. If you want a one-stop shop and a single app for all your financial needs, Pocket Expense is worth a download.

Compatible With

This app is very different than most on this list, but is still worthy of a spot as it’s incredibly valuable. This app aims to be a financial toolkit that allows you to accurately and quickly perform business valuations. So if you are looking to invest in or purchase a business, this app is a huge help.

In addition to helping with valuations, this app allows you to perform forecasting, equity dilution analysis, start-up evaluations, and much more. Whether you are just getting started in business or you’re a veteran with numerous ventures under your belt, this app is worth a download for sure.

While the Valuation App is definitely not for the average person, it holds a ton of value for people in this industry who are looking to get more into buying stocks and purchasing stakes in businesses. Best of all, the app is completely free, which is very impressive considering all the amazing features and tools you get with it.

Compatible With

Mint is among the most popular personal finance apps and programs out there. Basically, it is a free and effortless way to manage all aspects of your finances in one place. It seems that, along with YNAB, Mint is one of the most recommended and popular finance apps and programs in the App Store.

Mint was created by the people behind TurboTax, and brings together all your accounts, credit cards, bills, and investments into one app. This gives you a complete look at your entire financial world–all without paying a dime, as the app is completely free. That’s right, one of the best personal finance apps out there is completely free, which is a major “selling” point.

In addition to that, this app has a boatload of different tips and tricks when it comes to saving, budgeting, and much more. The app is also great at creating budgets and can even create some budgets for you based on your spending habits.

Millions of people trust this app with their financial and personal information, so it is kept very secure and safe. This is a great app that is definitely among the most recommended personal finances apps out there, and for good reason.

Compatible With

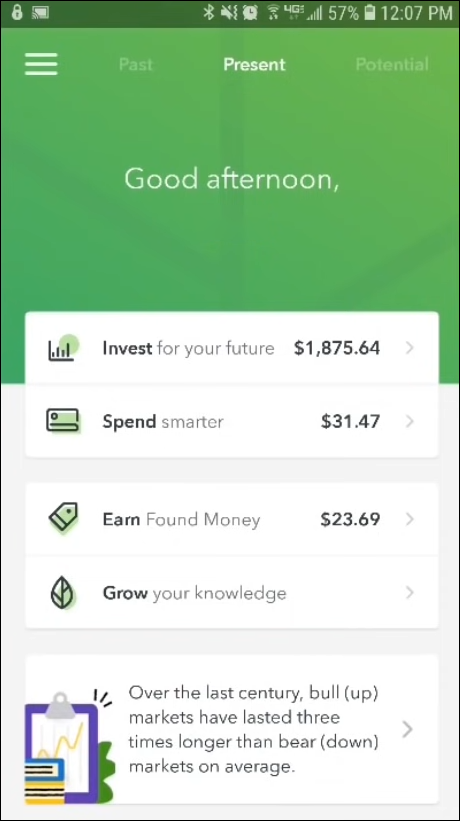

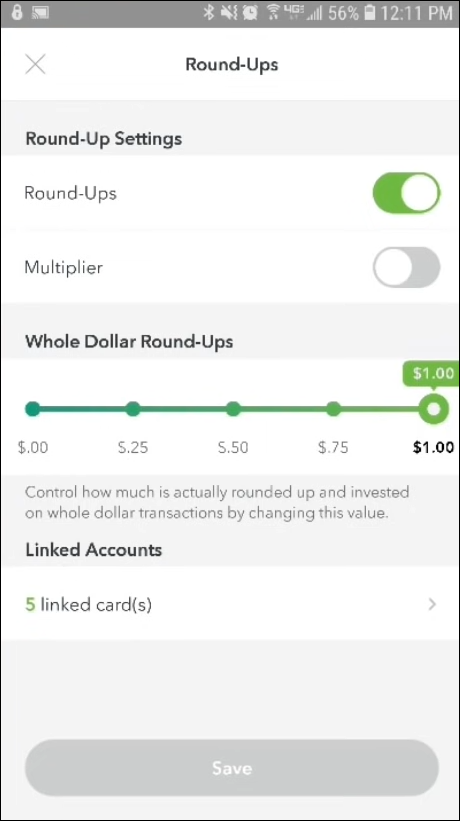

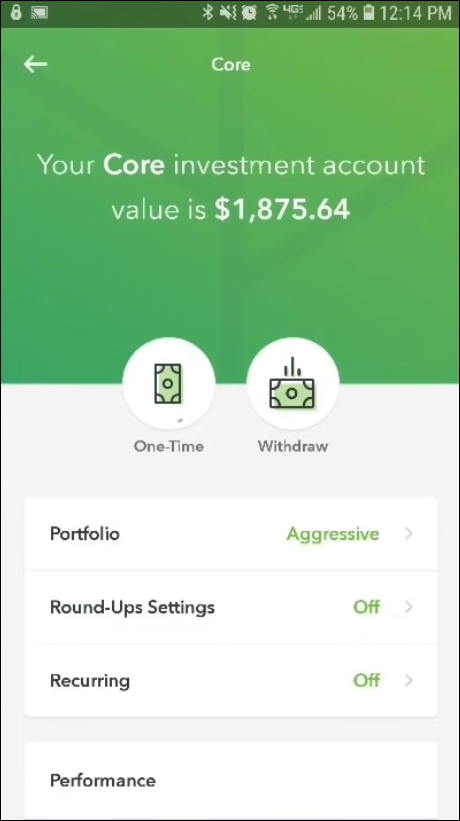

Micro-investing is the name of the game with Acorns. This is an app that helps you save and invest regularly into your own portfolio. You can start with your spare change and, very soon, you could have way more saved up and invested than you ever thought. Millions of people have downloaded and used this app, which only takes a few seconds to start using.

The account costs only a dollar a month, and what the app does is really quite genius. You connect the app to your accounts and cards, and every time you make a purchase, Acorns will round the purchase up to the nearest dollar. The app will then invest the excess and save it for you. While it may only be a few cents at a time, it will add up relatively quickly.

You can choose how often to invest, what to invest in, and much more. The app also includes access to Grow Magazine, a publication that will help you educate yourself on all things related to personal finance. All in all, this is an amazing, hands-off app that can help you get started with investing, without you even having to do anything.

Compatible With

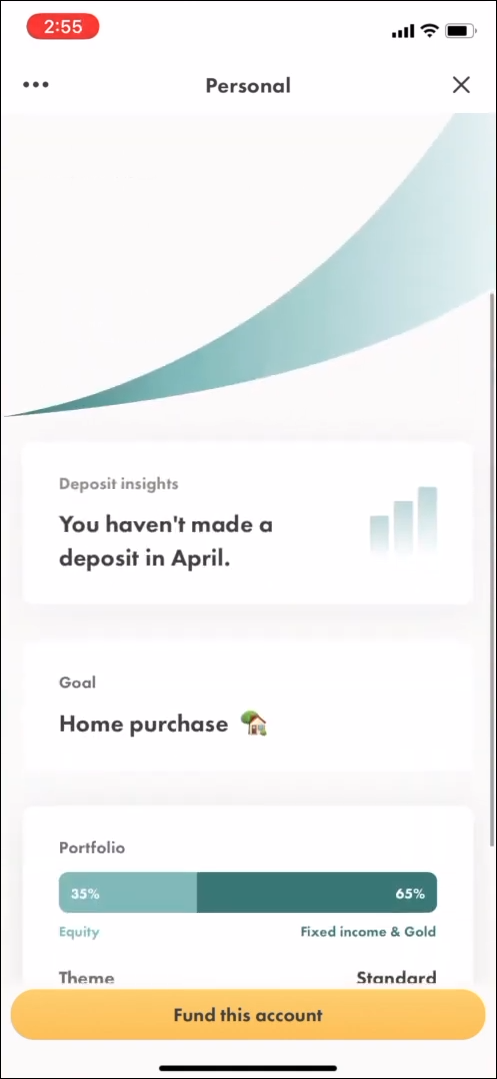

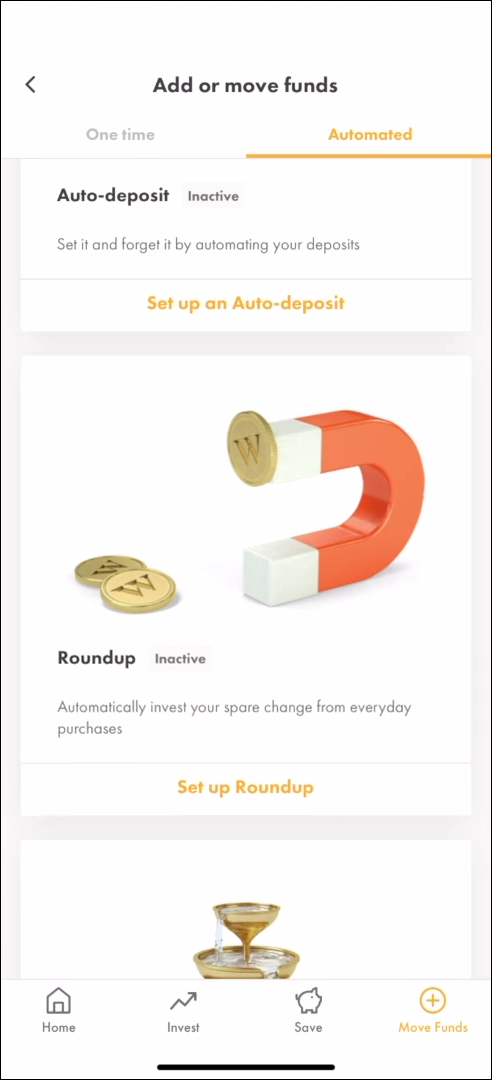

Let’s face it, investing can be a frustrating and confusing thing to do. This increases tenfold if you aren’t that well educated in personal finance. Thankfully, Wealth Simple makes investing incredibly easy. In fact, the app makes it so you rarely have to do a thing.

In about 5 minutes, the app builds you a custom investment plan. This plan takes into account a number of different things such as your risk tolerance and more. You get a balanced portfolio and the fraction of what it would cost from a traditional, real-life adviser. In fact, you are only charged 0.5% of your assets, which is around one fifth of what most people are paying for their mutual funds.

Wealth Simple also offers great customer service via phone, email, and even text message. If you want to get into investing, and pay a very small charge to do so, checking out Wealth Simple could be one of the smartest things you do.

Compatible With

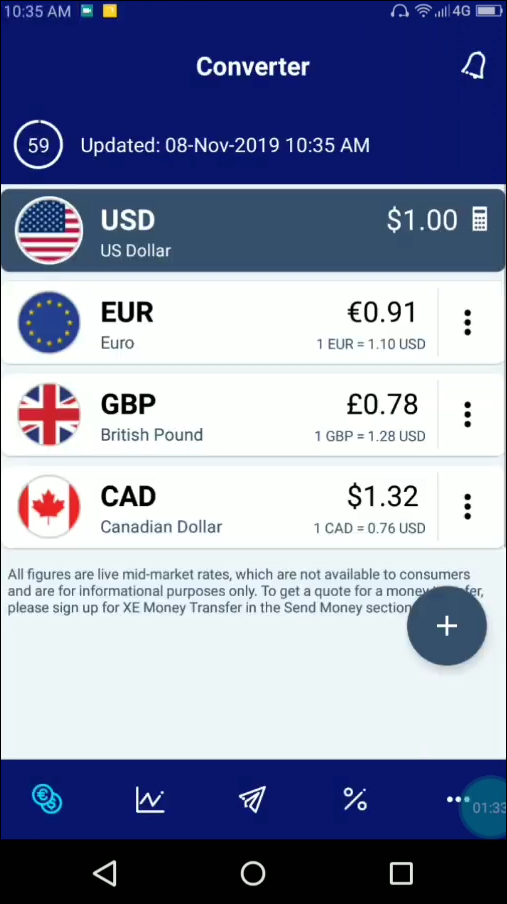

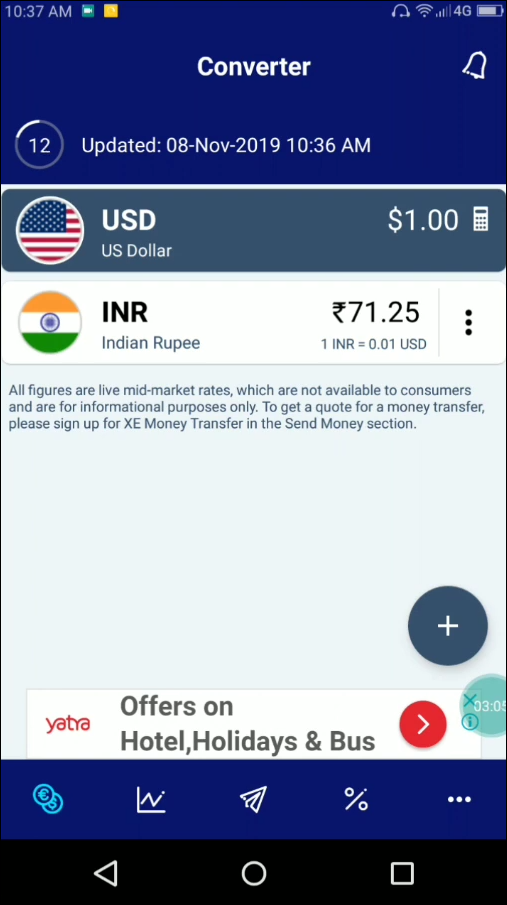

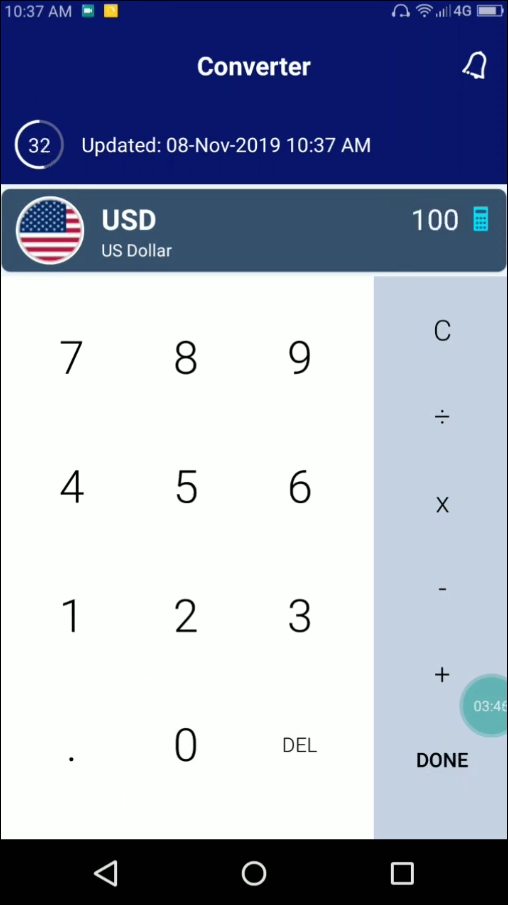

This app is unique on this list because it doesn’t necessarily help you with your finances, but it is still definitely useful. XE Currency is a currency conversion app, which can always be helpful when you’re traveling or just seeing how your local currency compares to other.

This app has been downloaded more than 50 million times and is unique among currency apps, as it will even work when you aren’t using the internet. This is because it stores the last live currency conversion information when it is connected.

In addition to converting currency, XE Currency has a boatload of other features such as looking at past performance of currencies, and monitoring numerous currencies at once. This app features every single world currency as well as precious metals, so no matter where you are or what you want to discover, it has you covered.

Compatible With

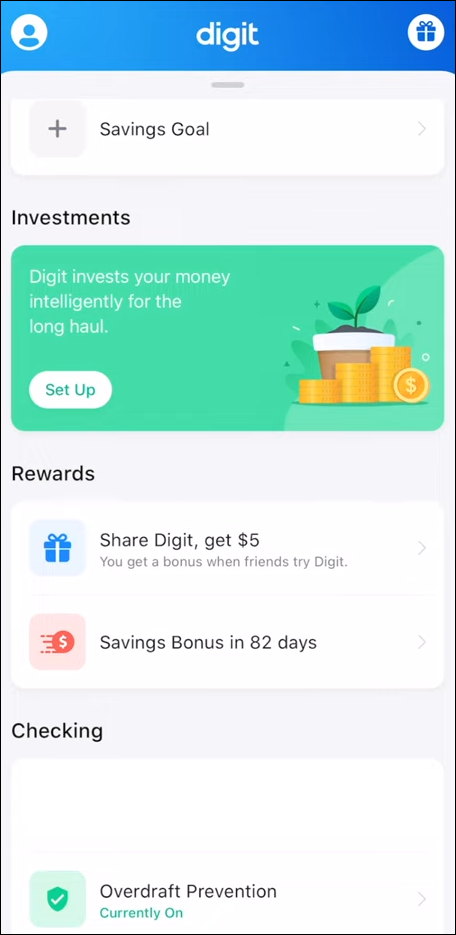

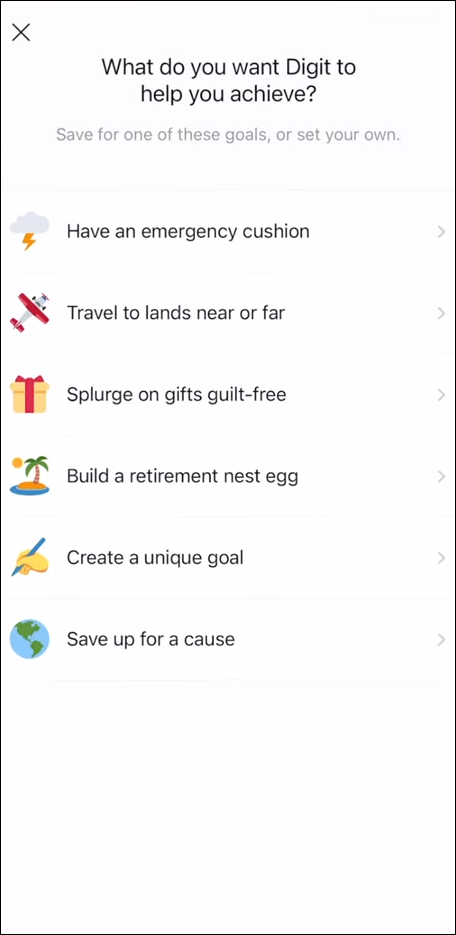

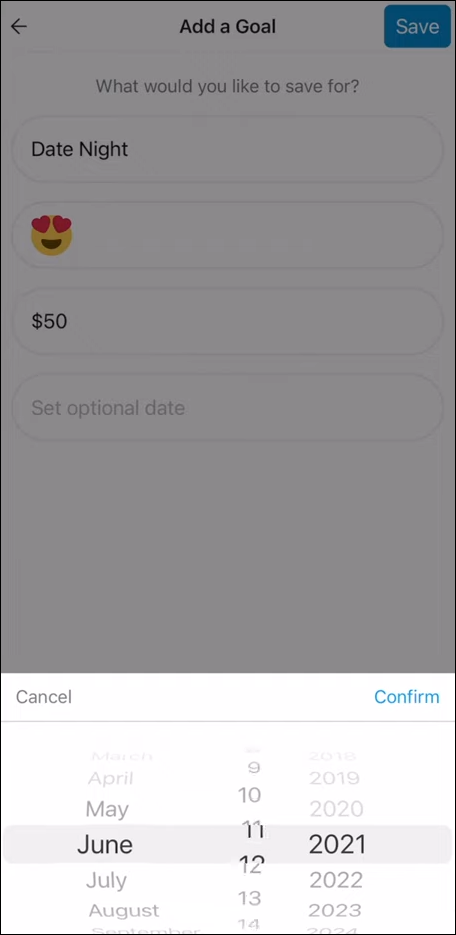

While many of the apps here praise using a budget, you don’t need one to save money with this app. Digit is a useful app that automates saving money for you without even thinking about it. Every few days, Digit will check your spending habits and, if you can afford it, it will take a few dollars from your checking account and save them.

The first thing you have to do for this app to work is connect it to your checking account. This helps the app see your finances and analyze your spending habits and income. Every few days, the app will send between $2 and $17 from your checking account if you can afford it. Don’t worry–the app will make sure to only do so if you can afford it.

Digit allows as many transactions from your savings account as you want for free. The security on this app is on the same level as many banks, so you can rest assured that your personal information is safe.

Compatible With

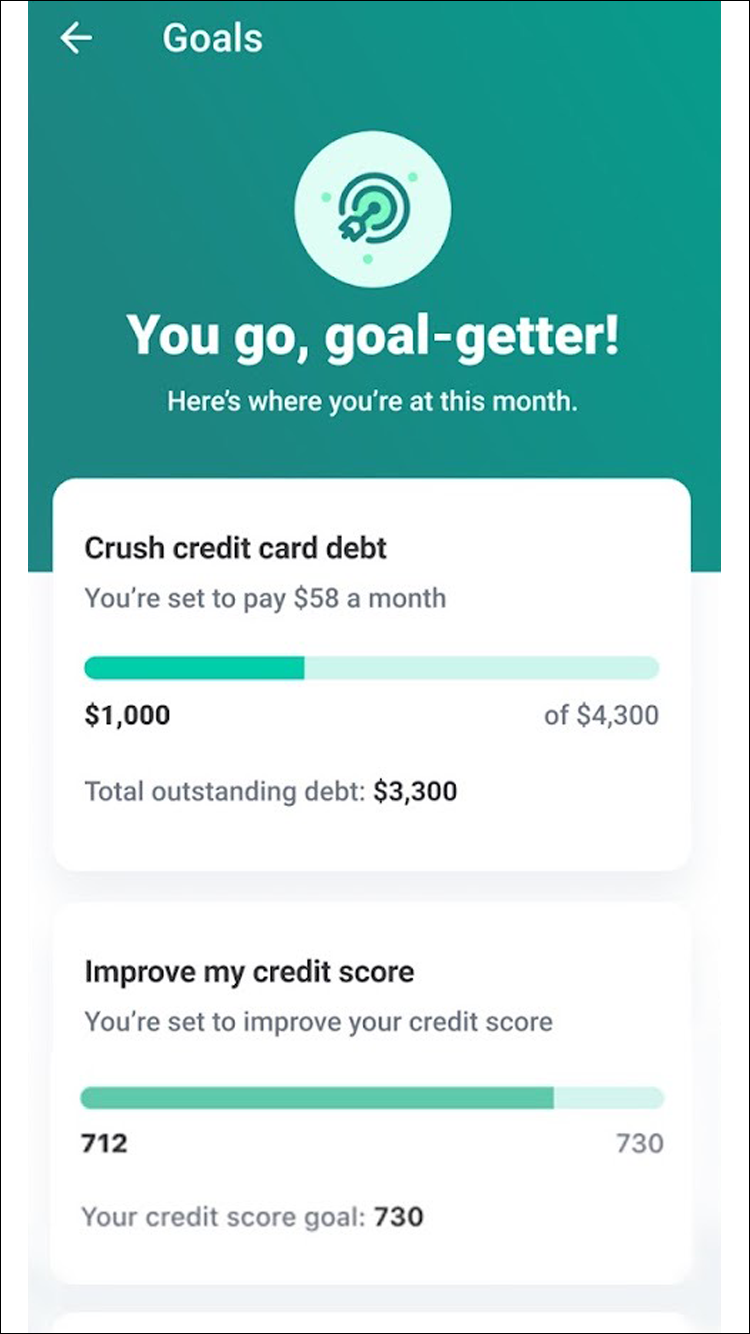

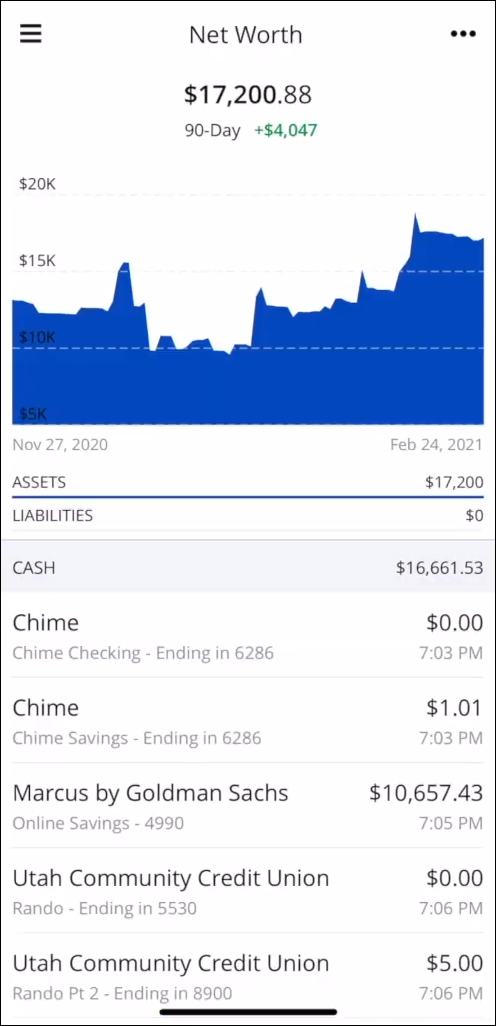

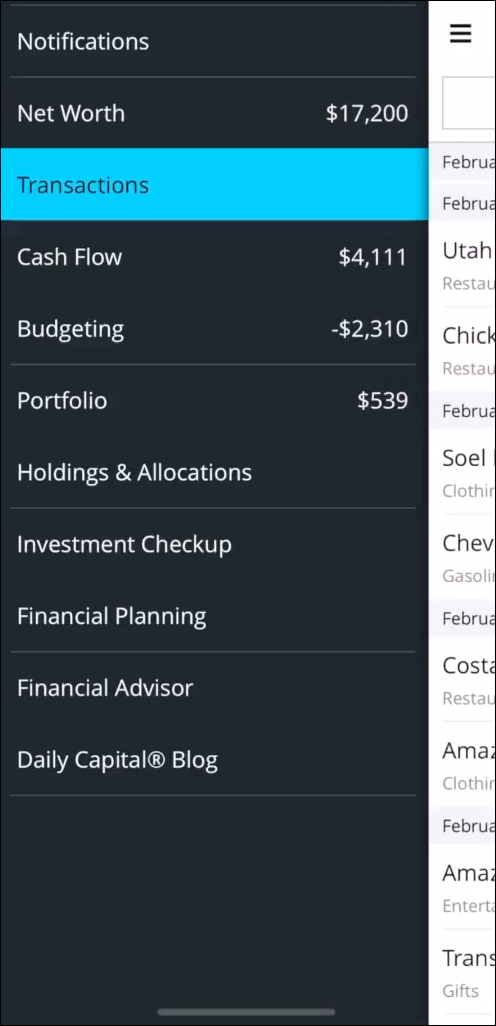

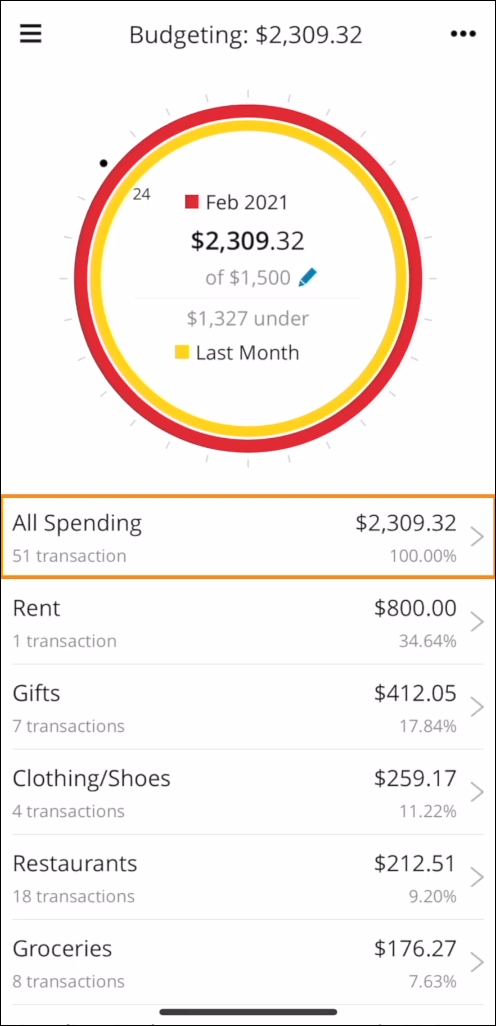

Personal Capital is an incredibly comprehensive tool that gives you an intelligent way to track and manage your entire financial world. The apps mixes amazing tools with advice from financial planners. This helps you get a hold of your finances and manage them correctly.

The dashboard of this app keeps all your information and accounts in one place, and is a true one-stop shop. You can create and edit budgets, enter and view transactions, get personalized advice, track and manage investments, plan for retirement, and much more.

The app is free to sign up for and over a million people use it to manage and track billions of dollars. Personal Capital is among the most comprehensive apps on this entire list, and is definitely worth a download if you are ready to improve your financial picture in a big way.

Compatible With

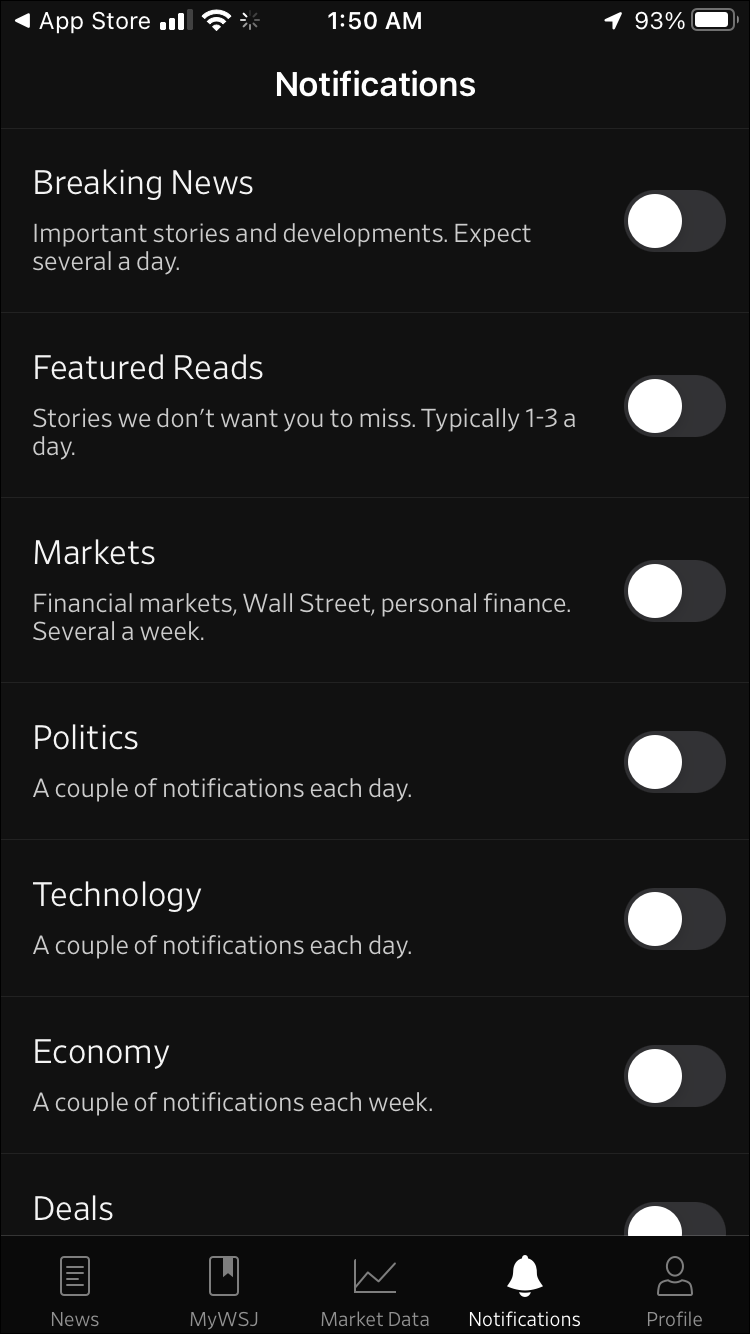

This app isn’t about controlling your money, making a budget, investing, or anything like that. Part of becoming better at personal finance is constantly learning. All of these other apps are great, but they aren’t worth much unless you are keeping up with the times.

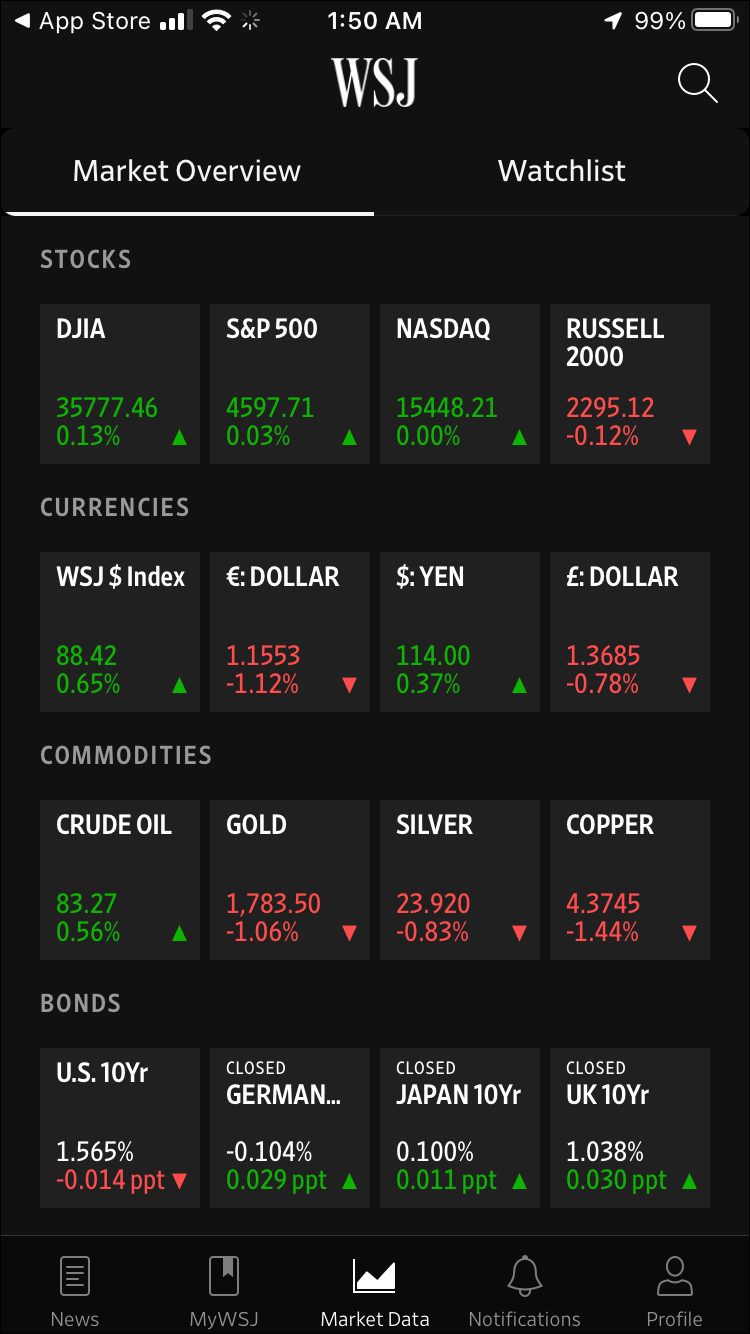

The Wall Street Journal is a great resource for learning about the news of the world in business, finance, and much more. This app gives you instant access to a number of different stories and articles that will make you a much smarter person, and keep you on top of business developments.

While this app isn’t purely about personal finance or finance in general, there is a lot of content there. If this isn’t your style, there are a ton of different “news and finance” related apps that can really help you become more educated, which will, in turn, make you better capable to manage your finances.

If you don’t see an app that should be here, let us know what it is