How to Create a Budget in Google Sheets

People have been using Excel for budgeting ever since it existed, but it turns out that nowadays, more and more people are switching to Google Sheets. The reason is obvious: Google Sheets is easier to use, and you can access it from all your devices.

In this article, we’ll show you how to use Google Sheets for budgeting effectively. You can use one of its pre-made templates or create your own sheet with our help.

Budgeting Templates

If you don’t have time to create your own custom spreadsheet, don’t worry. Google Sheets has tons of free templates, and you can customize them according to your personal needs. We’ll now show you how to use them. We’ll use the Monthly Budget template as an example, as most people track their expenses monthly. Here’s how to find it:

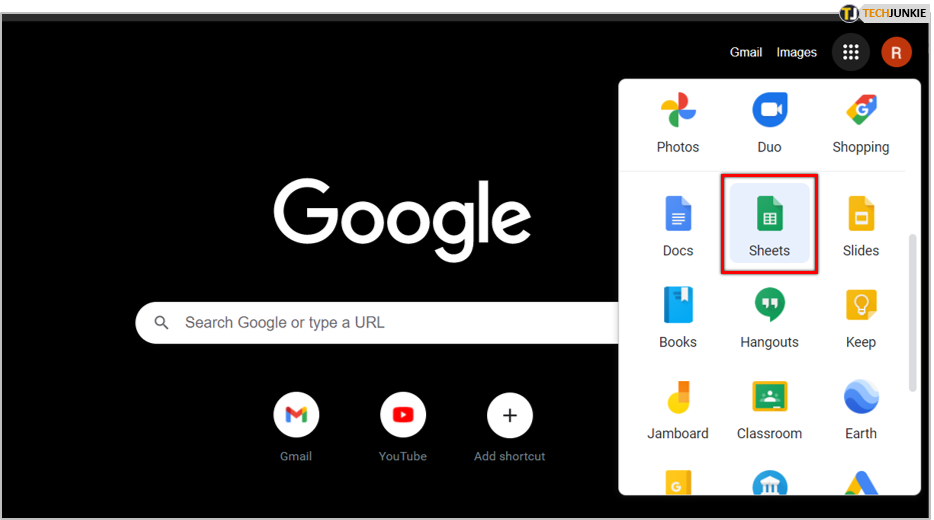

- Open Google Sheets.

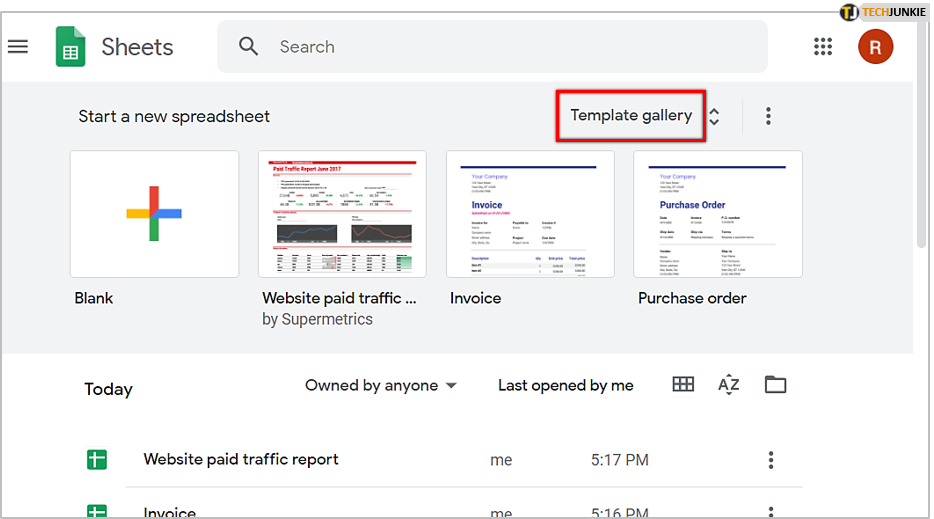

- Open Template gallery.

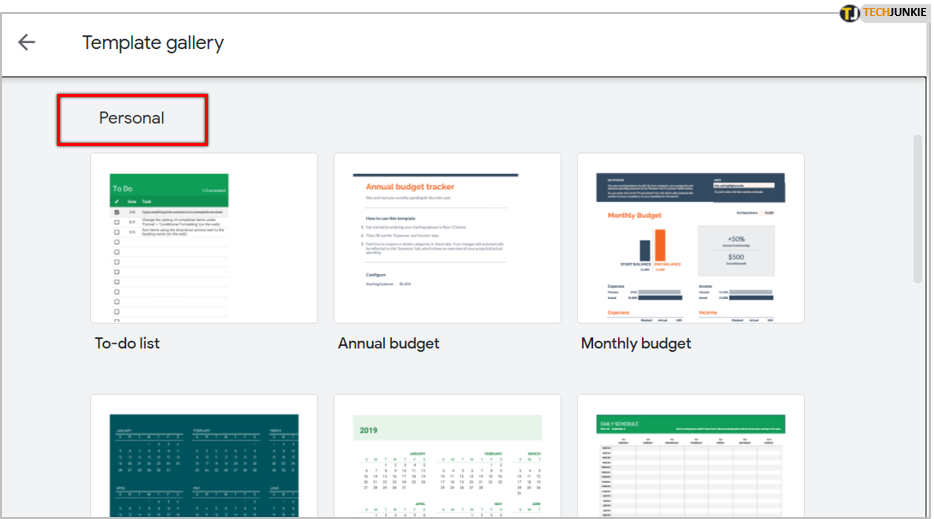

- Scroll down until you see the Personal section.

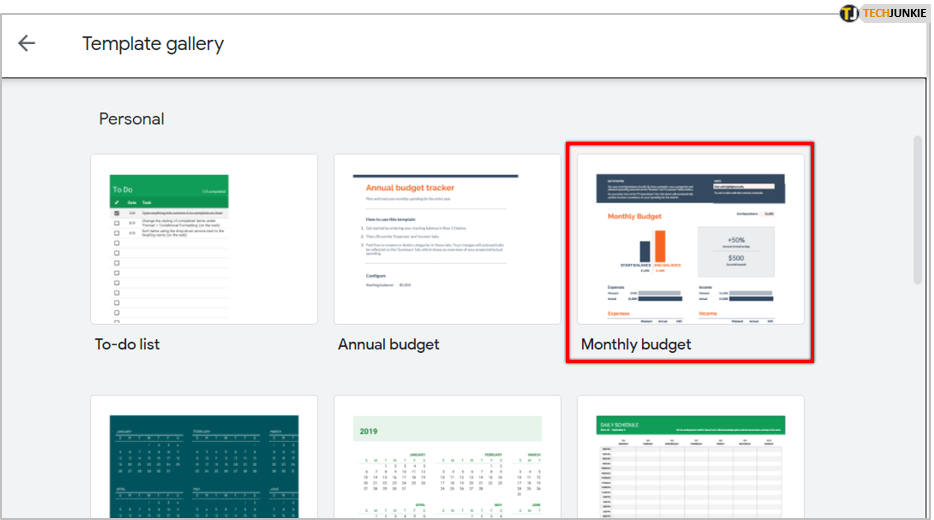

- Select Monthly budget.

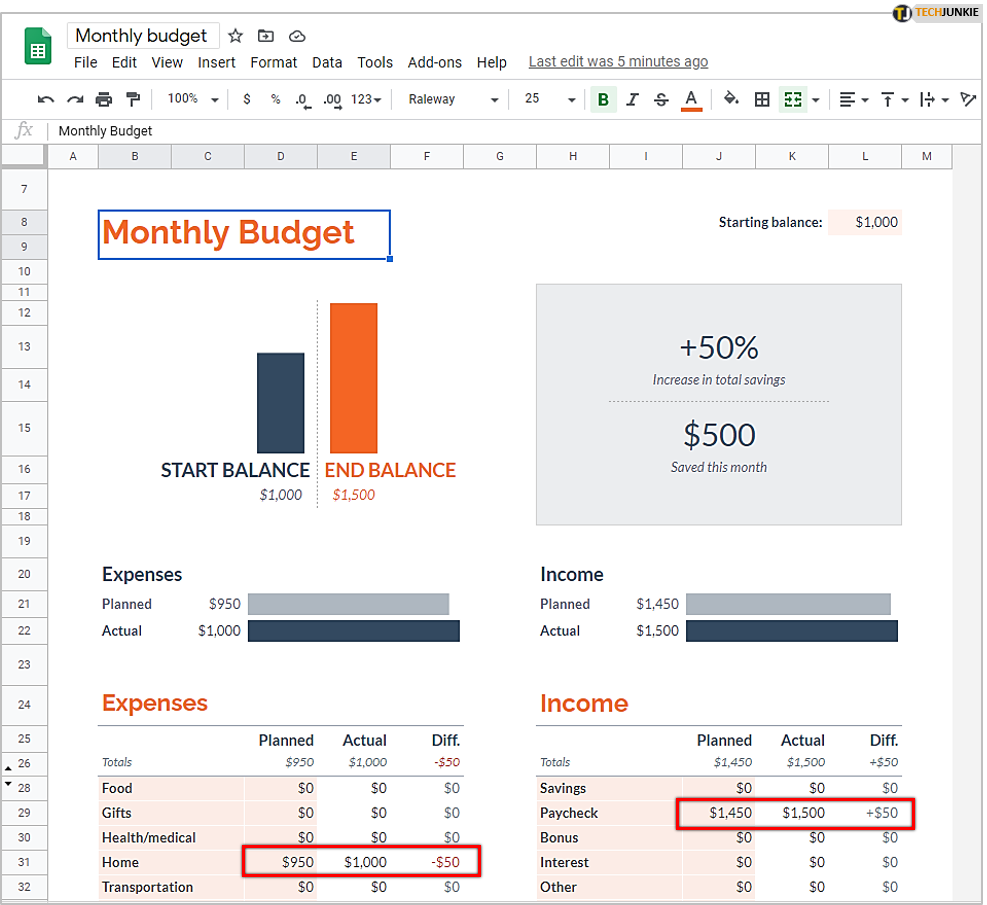

When you open the spreadsheet, you’ll notice that it already has some amounts in it, as an example. You need to clear Transaction and Summary spreadsheets, but it’s not enough just to delete the amounts (if you do so, you may alter the formula).

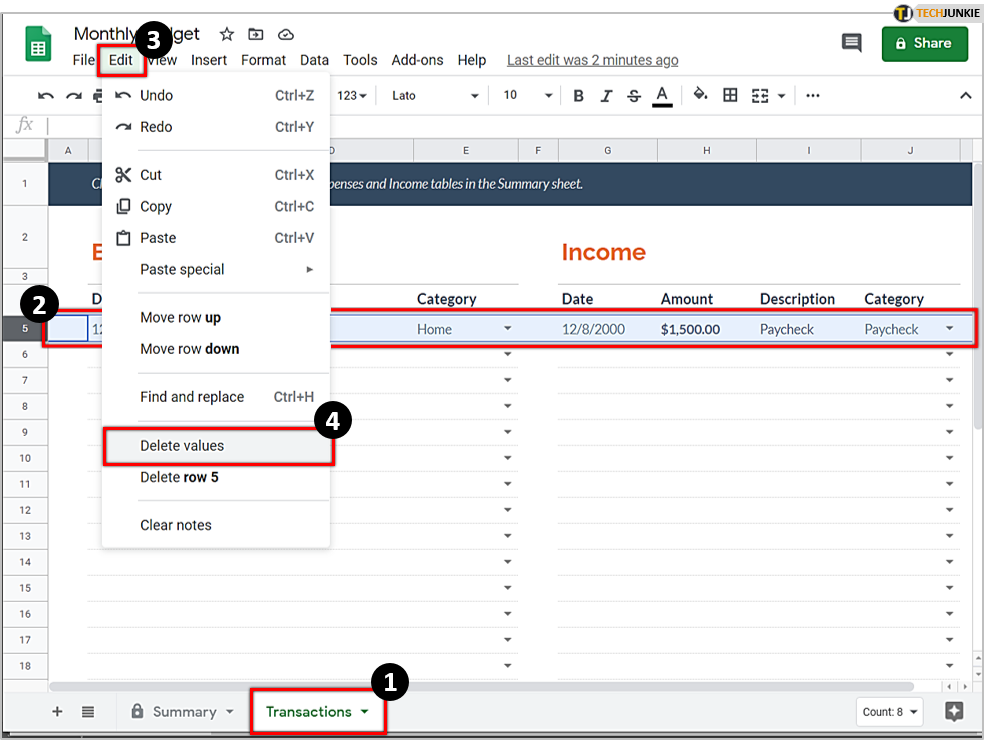

Go to the bottom of the screen and click on Transactions. You need to remove sample amounts for Rent and Paycheck. To do so, you have to select the entire row, and then click on Edit, and click on Delete Values. Repeat the process for the other row.

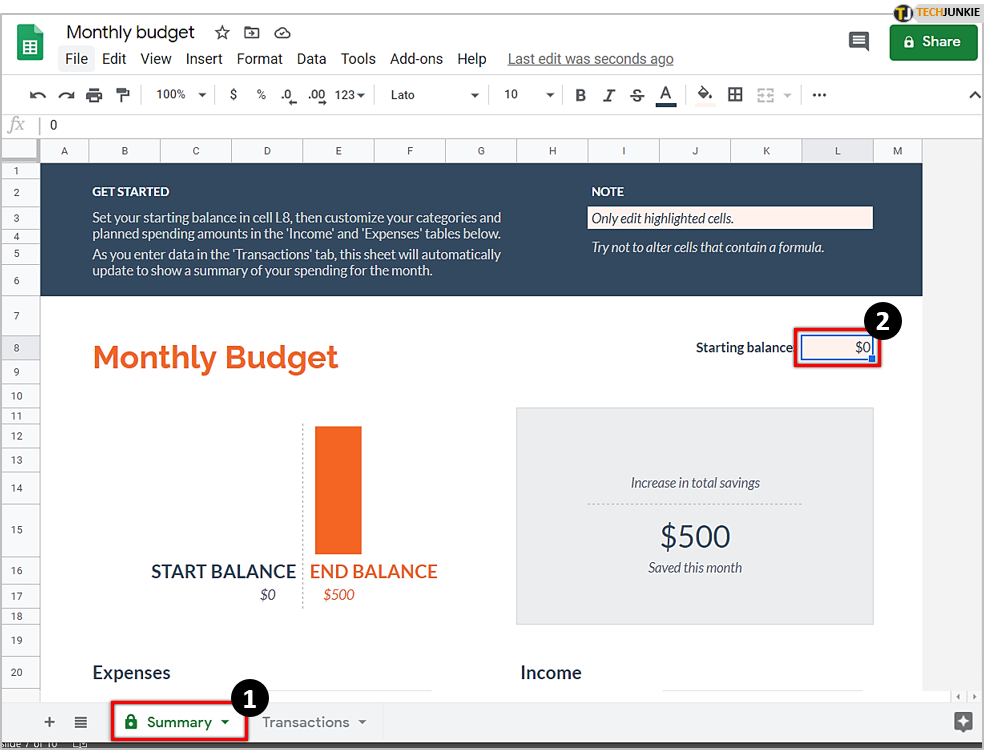

Now, go to the bottom of the screen and click on Summary. Change the amount in cell L8 from $1000 to $0. Do the same for the Home and Paycheck amounts. That’s it! You’ve now got a blank spreadsheet, and you can start filling it in with your data.

Customizing the Template

Everyone’s way of budgeting is different, and you can add any category you like. For now, you have only two spreadsheets – Transactions and Summary. We suggest you add a third spreadsheet for Fixed Expenses that you know you’ll have every month. Go to the bottom left corner and click on Add Sheet.

You can name the new sheet Fixed Expenses, and you can add as many categories as you want – utilities, mortgage, subscriptions, etc. Don’t forget to enter the amount you have to pay every month. Sum up all your fixed expenses and enter that amount in the Summary spreadsheet. We suggest you use the first column in Summary for this to make it easier to track.

Now, you don’t have to think about those expenses anymore, and you can focus on your daily expenses so you can take control of them. You can add new columns in the Summary spreadsheet based on the things you spend the most money on. Your columns could look something like this: Groceries, Clothes, Entertainment, Coffee (Yes, coffee! Most people spend more money on coffee than they actually realize.)

Bonus Tip: Make sure to create a copy of your customized template and use a copy for budgeting. That way, you’ll have a pre-made template every month, and you won’t have to go through all of this each time. For example, if unplanned expenses occur in August, you can add a new category for only that month, without modifying the original version.

How to Make Your Own Template?

If you have time, it can be a good idea to create your own budgeting template. That way, you can customize it according to your needs and spending habits. Here’s a detailed guide on making your own budgeting template:

- Open a new spreadsheet.

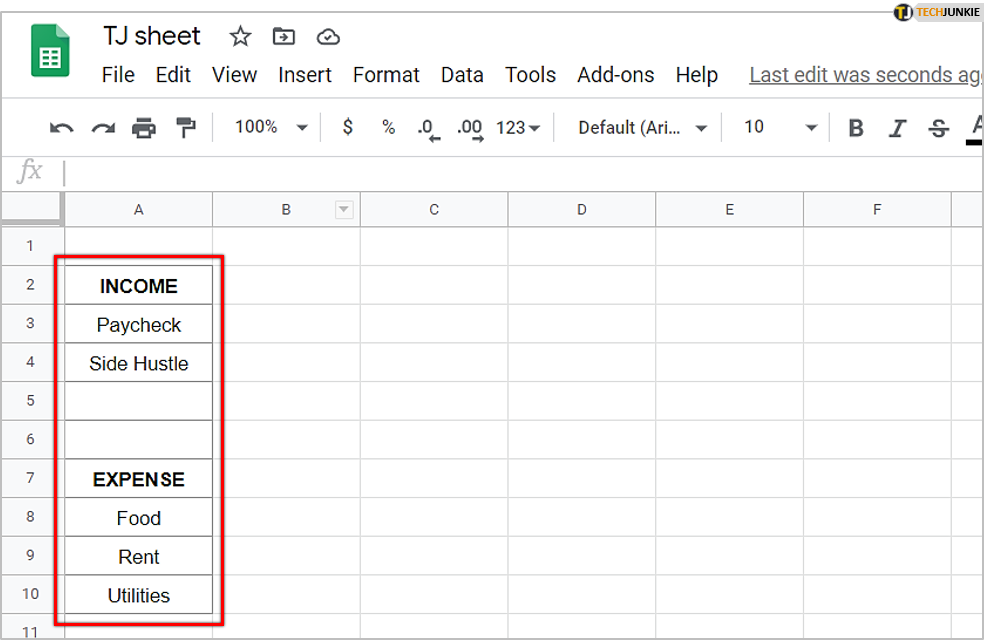

- Create Income and Expense categories (you can choose the number of categories).

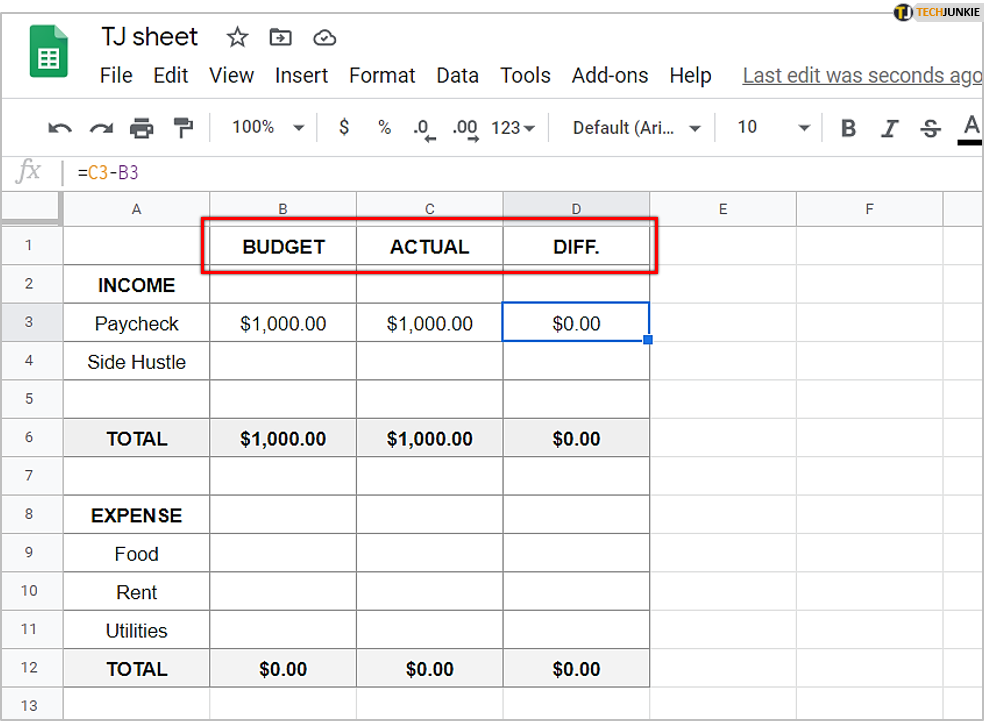

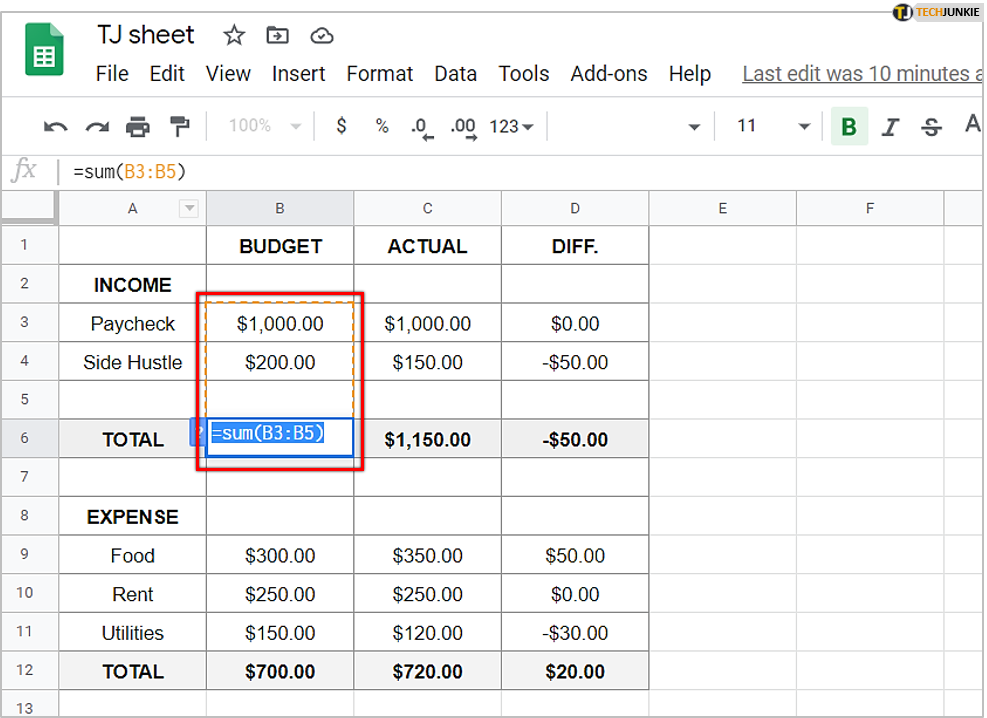

- Create three columns: the first one is for your budgeted income and expenses, the second one is for your actual income and expenses, and the third one represents the difference between the first and the second one.

- Use the SUM formula to sum up the amounts from each column.

There you have it! That’s your template. You can start by adding the budget you plan for a given period. You can do this for a week, month, year – whatever suits you. Now, all you have to do is regularly update your budget, after every transaction you make. No matter how small the amount may be, because small amounts can add up with time and create a big difference.

Remember, practice makes perfect! If you don’t have a lot of experience in budgeting, you may not be able to stick to your budget in the first month. Don’t let this discourage you from budgeting. It can actually give you meaningful insights and help you realize what you are spending your money on and if there are any areas where you could save some money.

Use the App!

The biggest advantage of Google Sheets is that it has a handy mobile phone app that you can use for tracking your daily expenses. You have your smartphone with you all day, anyway, so you can check in with your budget before you make any money-related decisions. You can see how much money you’ve got left for that month and whether it’s really worth it to spend on something.

Do you have any other tips for budgeting? What works best for you? Let us know in the comments section below.