Everydollar vs Mint

For the longest time, Mint had ruled the roost in the financial budgeting, tracking, and management scene. But over the course of the last decade, personal budget management has matured quite a bit. Enter in two of the more prominent names in web-based budgeting tools on the market today. The aforementioned Mint and the challenger, EveryDollar. Neither is a one-size-fits-all solution for everything that you’d want when organizing your finances though both have their own unique features to set them apart.

“So which one is the best?”

Well, to be honest, that will be dependent on what exactly it is you need out of your budget planner. Month-to-month budgeting a key concern? I’d go with EveryDollar’s simplistic approach. Looking for an affordable option on yearly financial tracking both current and past? Then Mint takes the cake. This is only a small sample size of the differences between the two.

Below, I’ll go into what each product is and what it’s about, where and how to get set up, what features are offered, and a final summary, beginning with EveryDollar.

What Is EveryDollar?

EveryDollar is a relatively new budgeting app created by personal finance guru Dave Ramsey and released in 2015. Its purpose is to smooth over the budgeting process, making it easier for users to find the financial freedom they’re looking for. EveryDollar follows the principles of zero-based budgeting, which is a system of income allocation used to ensure that all money received goes toward totaling your monthly expenses to zero. This method enables you to create a new budget each month in order to not carry over expenses to the next.

You have access to a free and a paid version of the program with a 15-day free trial to test out the perks before forking over $99 on a one-year subscription.

Pulled directly from the EveryDollar website:

“EveryDollar helps you create a monthly budget so you can achieve your money goals. Say goodbye to money stress and hello to confidence in your financial future.”

EveryDollar is solely focused on being a budgeting software to help people keep their finances in order. This results in a simple, easy to use application that doesn’t try to be something it’s not.

How Does It Work?

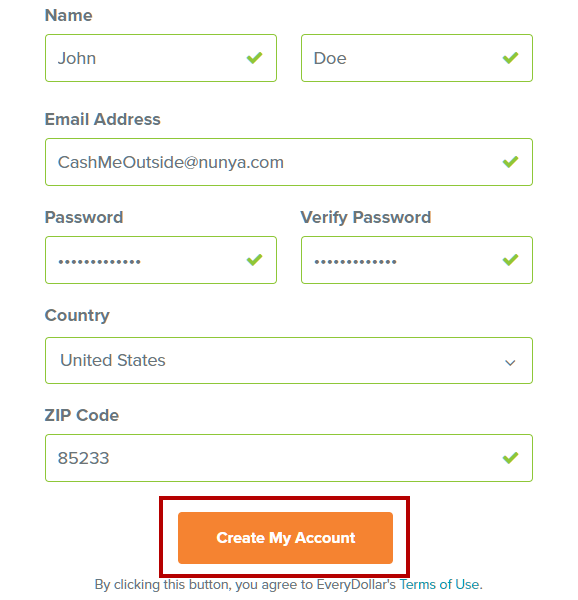

To begin, you’ll need to create an account on the official EveryDollar website.

- Fill out the required fields consisting of your full name, email address, and password, current country of residence, state and ZIP code. EveryDollar is currently only available to residents within the US and Canada, so take that into consideration before proceeding.

- Once you’ve filled out all of the necessary information, you can go ahead and click on the Create My Account button at the bottom of the form.

- This will trigger a confirmation email response where in which you’ll need to confirm your credentials through the sent out email you should have now received. This confirmation email will be sent to the email address provided on your account creation form.

- Following the confirmation, you are now ready to use EveryDollar and can begin working on a budget.

You’re initially provided with eight spending categories with the option to create your own customized versions as needed. There are also savings accounts you can set up for whatever reason you so choose, which EveryDollar refers to as “Funds”. If you make a “Funds” category, this is considered a savings goal where you can set up a starting balance and the amount you’re hoping to save.

Beside each category, you’ll find an input box marked “Planned”. Here you’ll enter your current balance, savings goals, emergency funds, etc. You can also make notes within each category to track varying transactions made or funds received. A “Favorite” option is available for frequently used categories if you so desire, which will then show up at the top.

To the right of “Planned,” you’ll find “Remaining”. Both will show up in each category, “Planned” being your beginning budget and “Remaining” which is, well, the remainder of the set budget. “Remaining” is the default setting but you have the option of toggling over to the “Spent” setting if you’re wanting to view how much of the budget has already been used.

Once the accounts and categories have been set up to your liking, maintenance comes into play. Using EveryDollar Plus (the paid option), you can sync your categories directly to any of your bank accounts that you wish. This enables the accounts to auto-update themselves. However, those using the free version will have to do all of your updating manually. You’ll receive graphical displays detailing your current spending and saving trends to help you keep on track with your goals.

Dave Ramsey’s Baby Steps

Now that all of your income and expenses have been set up, you can turn to Dave Ramsey’s “7 Baby Steps” as your budget guide. You have the option to assess exactly where you are within your journey in order to help get yourself out of debt and start building your wealth.

The milestones of the “7 Baby Steps” are as follows:

- Save an emergency fund of $1000.

- Utilize the Snowball Method to pay off all debt. This method is completed by paying off your smallest debts first while building momentum towards tackling the larger ones.

- Focus on saving expenses to keep you afloat for 3-6 months.

- Always remember to set aside %15 of all income towards retirement.

- Begin a college fund for your children (current, future, or otherwise).

- Pay off your mortgage or purchase a home (and then subsequently pay off the mortgage).

- Capitalize on your current financial freedom to build your wealth and give back to others.

These steps are primarily here to guide you in changing your behavior, which is seen as the cause of an individual’s money woes, by providing a proven step by step plan of action.

What Is Mint?

Mint.com is a simple to use, web-based personal finance program that boasts over 15 million users. It currently is and has always been 100% free and takes minimal time to create a new account. Mint.com offers all-in-one access to your financial accounts, can be accessed via a mobile app, and helps you create budgets, set goals, and track expenses among other things.

Mint.com was acquired by Intuit, creators of the Quicken product line, the latter of which was acquired by Microsoft in 2016. Each time you visit the site your financial data will be updated automatically. The dashboard will always provide a quick summary of your personal finances and as a whole, Mint presents all information in an easy-to-use web interface including details via graphs.

Though it lacks a good many features, Mint is incredibly strong with budgeting and tracking expenses and is very helpful in creating goals and consolidating finances all in one place.

How Does It Work?

In order to get started with Mint, just like EveryDollar, you’ll need to visit the official website for Mint.com and create an account. This one account will span all of Intuit’s products which some may enjoy as a convenience. To begin:

- From the main page, scroll to find the SIGN UP FOR FREE button and click it.

- You’ll be taken to a new page where you’re asked to fill in your preferred email address for the account, a phone number (considered recommended), and a suitable, secure password. Mint is only available to those living as US or Canada residents.

- Once all relevant information has been filled in, click on the Create Account button at the bottom. A new page will ask you to fill out which country and zip code you currently reside in. Click continue.

You are now able to use Mint, Turbotax, and Quickbooks with a single account.

At this point, you’ll be asked to fill out more information pertaining to your finances. The first of which is what bank account(s) would you like to Sync with Mint? Mint is able to sync up with nearly every financial institution which makes setup a breeze.

Once bank accounts have been added, you’re free to add additional accounts for your credit cards, student loans, investments, etc. As more things are added, the bigger picture becomes a bit clearer, allowing you to see all of your finances come together.

A sample budget is provided for you consisting of a few categories based around your spending history. You can create your own budgets by heading over to the “Budgets” tab and selecting “Create a Budget”.

Choose a category and sub-category for your budget, preferably starting with your income, and from there creating each additional budget for your expenses as necessary. For each expense created, select how often each will occur and then choose the amount allotted within the category. You can then click the Save button.

Continue until all categories, such as groceries, rent, utilities, entertainement, etc. have been accounted for.

Using The Mint Apps

The Mint QuickView companion application is only available to those using Apple’s OS X operating system. It’s great for those wanting a quick glimpse of their personal finances without the need to head over to the website.

Easily install QuickView using Apple’s App Store and sync it up with your Mint.com account. This will create a green leaf icon at the top of your toolbar which will continuously run in the background. You can have it set up to alert you via badge notifications should your finances change in any way.

The other app option is the Mint.com app which can be downloaded on both iOS and Android mobile devices. This app offers increased security via two-factor authorization and Touch ID sensor for those using the iOS fingerprint scanning feature. With the mobile app, you can also easily sign up for alerts to be sent via email or directly to your smartphone for:

- Late Fees

- If you go over budget

- Bills need to be paid

- Changes in rates

- Any large purchases that have been made

Similar to the web-based program, the app services remain 100% free to use. If you’re wondering how a service like Mint makes any revenue when they’re giving it all away for free, here’s the 411.

Mint will recommend to you various financial services for which it receives a referral fee. It also offers packages on ways to save or make you additional income. Mint has also introduced ad banners to monetize users, offers you a sign-up to receive premium credit report access, and sells aggregate (not individual users) financial data to various providers. Data such as averages and consumer spending are collected anonymously and is not referenced back to any one individual.

EveryDollar’s Features

Broken down in Pros and Cons:

Pros

- Focuses entirely on its original purpose – budgeting. Sticking to its guns can be seen as a great thing as you will always know what to expect from the service.

- Features Dave Ramsey’s “7 Baby Steps” approach to debt recovery and wealth management.

- Superlative support in that if additional help is required, EveryDollar will put you in contact with local experts to provide you with advice on important financial information.

- Doesn’t overwhelm you with ads or recommendations in order to create revenue for itself and instead provides a completely ad-free service.

- The free version of the program comes with a visually appealing UI, easy-to-use budget creation, and is considerably user-friendly overall.

- The premium version allows for automatic transaction entries direct from your accounts.

- Multi-Transaction Drop allows you to select all transactions at once and drag them into their designated category.

- Allows for splitting your transactions into separate categories instead of having to type them all in manually.

- With EveryDollar Plus, your debts are sorted automatically in the preferred payment order using the Snowball Method.

Cons

- The free version is fairly limited. Forced to track all transactions manually or pony up the $99 for the premium version.

- The free version does not allow sync up with your banks or credit cards.

- The paid service is rather costly at $99 per year. For those attempting to get out of debt, the price tag could be seen as a real turn off especially considering all of the other free budgeting tools available elsewhere.

Mint’s Features

Broken down in Pros and Cons:

Pros

- 100% free – no exceptions.

- Financial data importing is automatic.

- Shines brightly at tracking your expenses.

- Strong reporting features that provide incredible details of your expenses stretching back years.

- Easily set up and manage new goals.

- Provides weekly summaries via email detailing what’s been happening with your finances.

- You can sign-up to receive email or SMS alerts on pending bills or changes in rates.

- Keeps you informed on where you’re spending your money using an easy to understand graphical format.

- View and monitor your credit score, account usage, payment history, and errors for free. Offers the option to upgrade to premium.

- Strong security enables two-factor authorization and Touch ID sensor (for iOS) for login validation to either your email or SMS.

- Allows you to import/export transaction data from/to Quickbooks

Cons

- Budgets can take considerably more time to create than other budgeting tools because of the auto-categorization feature.

- Has been considered buggy in the past. Bank synchronization issues are at the forefront, with the resolution time being quite lengthy if at all.

- Investment features are relatively non-existent, scoring an ‘OK’ at best.

- Inability to reconcile against your monthly bank statements.

- Canceled its Bill Pay feature a while back making the service less attractive to users.

The Versus Summary

The free version of EveryDollar is an amazing product. The budgeting features are easier to use than Mint, especially for first-time users of budgeting software tools. The premium option, EveryDollar Plus, adds great features, some of which Mint provides for free like automatic transaction importing.

It’s not trying to be a product for wealth management or investing and is far more suited to those in need of financial organizing than anything else. EveryDollar’s use of the “7 Baby Steps” is an incredibly powerful way to introduce users to the financial basics. It’s also a great option for those looking for a simple to use budgeting software without additional noise.

Mint is more attuned to the tracking of goals and credit scores than anything else. It does feature some investment tools but this is likely their weakest area of focus. Mint offered a Bill Pay option up until May of 2018 when it was removed for some unknown reason. This decision makes complete financial management using Mint a bit impossible at this point.

Mint is to me personally, more recommended for basic budgeting, goal, and credit score tracking than EveryDollar. It also possesses a more comprehensive financial picture and offers all of its features for free. Although EveryDollar does have the more intuitive and easy-to-use interface, the auto-transaction feature being stuck behind a paywall makes it less attractive to someone like me with limited time and income. However, those with disposable funds may feel that the features offered through EveryDollar Plus are worth the $99 per year investment.