GoodBudget – A Comprehensive Review

The approach you take toward building a budget should not be a complicated one. There are many ways that you can choose from to build a budget that works best for you. One of the more traditional methods is the envelope system, which is the method of dividing up your physical cash into separate envelopes for various expenses.

Goodbudget, formerly known as Easy Envelope Budget Aid, is a similar approach but in a virtual way. It provides a website and mobile app that allow you to specify how you allocate your finances. This proves a less riskier method than keeping tabs on your hard earned cash stashed in envelopes kept in a secret place somewhere in your home.

Secure the iOS or Android app for on the go budgeting, needing only an email address and password to sign up. Your account will sync up between app and website so no matter where you are, budgeting your finances is easy and efficient.

What You Need To Know About Goodbudget

Goodbudget puts its own spin on the envelope theory of budgeting wherein you would have an envelope full of cash designated to a specific monthly spending category, such as electricity and groceries. Goodbudget takes this concept virtual. You divvy up your money into digital “envelopes,” that pertain to your financial needs.

Imagine setting aside $200 for the electricity bill in one envelope while putting $100 into another envelope for dining out expenses. Goodbudget will keep track of the money you currently have placed in each envelope. When you remove money for the designated expense, it will remove that amount from the category. Once the money in a category is depleted, you can no longer pull from that “envelope”. You are able to choose from pre-labeled envelopes or create your own. Goodbudget helps you organize and track your expenses using a platform that can be synced across multiple devices.

It’s quite difficult for margins to break even based on the average spending and earning of most of today’s American households. Budgeting itself may not necessarily help you to meet your financial goals but controlling your spending can still prove useful. Is the envelope method the most effective way to budget your finances? Let’s take a look.

A Deeper Dive Into How It Works

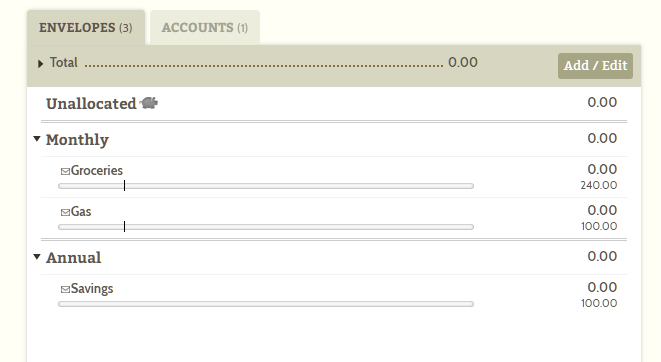

Goodbudget gives you digital envelopes to allocate money toward both frequent (monthly bills and entertainment) and annual (vacations and rainy day) expenses. You can begin by adding a financial account envelope like a checking, savings, or credit card account. Add additional customized envelopes categorized toward your planned expenses. Every time money is spent, you should update these envelopes corresponding to what the funds were used for.

Branching off of the previous example, we’ll use the $200 allotted to your electricity bill and $100 for dining out expenses. If your bill comes in at only $172 for the month, you would click Add Transaction and enter in the total spent and what it was spent for. Then, follow it up by clicking on your electricity bill envelope. The money will be subtracted from the initial $200 total and now show as $28 leftover. This will show that you still have $28 you can rollover to the following month for electricity. You could also choose to Add Transaction and swap that money into another envelope.

Your envelopes will each be represented by a color indicating current activity. Either green, meaning you have money still available in that envelope, or red meaning that envelope has been depleted or gone over budget.

I may have gotten ahead of myself a little bit. Perhaps I should first cover how to sign up and setup your account.

Setting Up A Goodbudget Account

Like most online account setups nowadays, creating one for Goodbudget is a breeze.

To sign up:

- Head to the Goodbudget website and click on the large, orange button labeled SIGN UP.

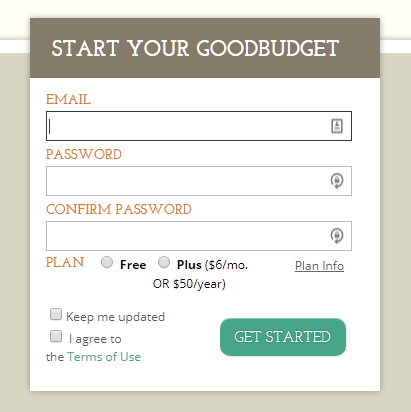

- You’ll need to fill in the information required which consists of your email address, a password, and which plan you’d like to sign up for. Goodbudget offers a free and a premium plan that I’ll get into a little later.

- Check off the “I agree to the Terms of Use” box and click on Get Started when you’re ready to proceed.

- You should now be at your Goodbudget Dashboard looking at a few default envelopes. From here you can create your own customized envelopes by clicking the Add/Edit button (which is recommended) but not before adding your personal account. Swap over to the “ACCOUNTS” tab and click the Add/Edit button there instead.

- Type in a name for your account, choosing either a “Checking, Savings, or Cash” account to add or one of your credit cards. Only those who currently have a premium account can add credit cards.

- Once your account name has been determined and you’ve added the total balance, you can click the Add button just below it.

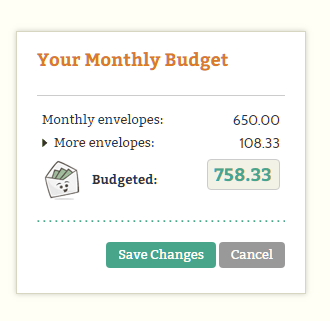

- When you’re satisfied with the accounts added, click the Save Changes button to the bottom right of the screen, located inside the “Your Accounts” box.

- Now you can head back to the “envelopes” tab and start creating categories based on your budget plans. You’ll have two different types of envelopes to create. those for short-term/monthly expenses and those for your annual expenses.

- Add a new envelope where necessary, fill out the budget amount, click Add, and when finished , click Save Changes.

- Now, to tackle the money earned or expended portion using the Add Transaction icon located at the top of the screen. You could add each transaction one by one or upload a CSV file from your bank account. This particular option benefits those most with a set, bi-weekly income. Freelancers with varying incomes would have a better time entering transactions one at a time.

- When finished filling out the information, click Save in the “Review and save” box.

- At this point, you can start filling in your envelopes. By clicking on the Fill Envelopes icon at the top of the screen you can begin allocating the amount needed in each envelope. Similar to the “Add Transaction” area, you can fill them in one at a time or all at once.

- Don’t forget to save when finished!

Congratulations! Your Goodbudget account is all setup and is ready to be put to use. The key is to take the information provided in front of you and refrain from going over budget in any of your envelopes.

Pricing Plans

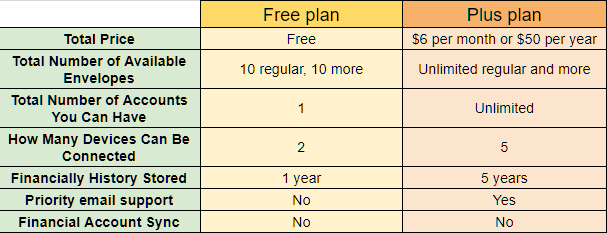

Goodbudget is free but does offer a premium plan with additional perks. Both versions allow you to login on desktop and mobile devices, adjust your budget, schedule transactions, and set email notifications.

You can also import your bank account information via CSV file which makes things a bit more efficient. There are also plenty of graphs and charts provided in both plans that will help visually represent earning and spending habits.

Below is a chart on how they differ:

The free version clearly has a few limitations but not enough to force the average user into considering the Plus plan as a necessity. You have access on two different devices making it ideal for a married couple looking to budget their finances together. Not shown in the chart but previously stated, those who want to monitor both bank account and credit card spending simultaneously will need to look into the pay option.

Being restricted to a single account and a max of 10 envelopes in both the monthly and annual sections can be a bit annoying to those with a larger budgeting issue. Those who happen to have multiple budgets in need of balancing may want to look into the Plus plan for the unlimited envelopes, accounts, and priority email support.

What Other Users Have To Say

Goodbudget is generally praised by most experts and users alike, garnering an average 4 out 5 from most sites. Even Goodbudget Budget Planner, the iOS app, sits at a 4.7 out of 5. Some go on to praise it as “the most used app on my iPhone.” Sites like thebalance.com ranked Goodbudget at #6, rating it as a budgeting app that is “Best for Couples”.

Though, not all reviews are as revered with the product, a few giving it a 2 out of 5 stars rating claiming, “Not really that comprehensive as [originally] thought.” Saying it’s great at the beginning but becomes confusing as income numbers begin to mount. PCWorld gave it a 3.5 out of 5 primarily due to the fact that Goodbudget doesn’t sync up with bank accounts and that it may be too confusing to some who “already see budgeting as a hardship.”

The Good

Being able to see first-hand what Goodbudget offers, I have to say the app proved positive. It was incredibly easy to setup and navigate, providing a straight-forward system to budget my expenses. You can breakdown your budget by expense and view personalized reports based on your spending. In short, it does as advertised.

I have not yet tried out the Plus plan (cause I’m cheap) so I can’t give a review of its perceived positives are valid. Though, I will say that if improves on what the free version offers, which it looks to do, then I’m likely to rate it similarly.

Having access to my budget directly from my iPhone is incredibly helpful. It makes it so that at any point I feel the need to splurge, I can compare the cost to what I currently have in my “entertainment” labeled envelope, to prevent me from going over budget. Yes, it does work for Android too.

The Bad

Goodbudget does not sync up with financial institutions so you’re forced to manually enter any money that leaves and enters your bank account. It can require a bit too much daily attention for those who prefer a more fully automated system.

The free version doesn’t include enough envelopes for everyone so the restrictions could turn off those who already have a rather strict budget. Especially seeing as paying for a budgeting system could be seen as a bit counterproductive.

Another issue actually deals with the mobile app. Not everything is controllable unless you’re logged into the web browser version. This is the only way you can edit budgeting periods or listed accounts. Something like this could prove tedious for those who don’t always have access to a computer.

Final Thoughts

Overall I’d say Goodbudget is decent at best, tedious at worst. It’s both simple and intuitive but seems to be a bit high-maintenance in comparison to other budgeting programs that are available. It’s incredibly helpful to those just starting out or who prefer a more hands on approach to handling their money. The Plus plan seems to alleviate a few of the problems that the Free plan has but not the biggest one – no financial sync.

Bottom line, Goodbudget is great for budgeting beginners, even more so married couples looking for a cheap solution. However, there are a few better solutions for those seeking a more all-in-one budgeting option, complete with additional bells and whistles, to help out with all the heavy-lifting that Goodbudget can’t seem to handle.