How Often Does your FICO Score Update?

How often does your FICO score update? What’s the difference between FICO and your credit score? How can you check them and how often should you check them? We seek to answer all these questions and perhaps a few more on this page.

FICO scores and credit scores are different things and it’s important to know the difference.

FICO scores are one type of credit score invented by the Fair Isaac Corporation back in 1989. They use a mathematical equation to create a score that some lenders use to assess your creditworthiness. While FICO 9 was released back in 2014, most lenders still use FICO 8 which is a very popular version of the model. A new UltraFICO score will be released sometime in 2019.

A credit score is a general score generated by Equifax, Experian and TransUnion, the three largest credit bureaus. They take financial information from your bank, mortgage, loans, checking account, credit cards and anywhere else you may have finance to create a score. That score indicates your creditworthiness. The higher the number, the lower the risk you are to lenders.

So FICO is one type of credit score while a credit score describes the report generated by Equifax, Experian and TransUnion.

How often does your FICO score update?

Both your FICO score and credit score are usually updated whenever there is a change. Most banks and financial institution provide monthly reports on their customers and if anything changes in that month your FICO score is updated. If nothing changes, it won’t change much or at all.

Some premium FICO products may have a different schedule and update monthly, every 45 days or 90 days.

Typical financial changes that will trigger a FICO score update include:

- Payment history updates for loans and credit.

- Time since the last late payment, collection account, or public record item.

- Adding or removing credit accounts, collection accounts and public record items.

- Increases and decreases in credit balances.

- Changes in credit mix such as types of credit.

- Length of credit history.

- Number and type of hard inquiries.

According to myFICO, these are the main things that trigger a change.

How much does your FICO score change over time?

The change depends entirely what’s going on in your life. If you’re in a comfortable position and are not buying on credit, applying for loans or mortgages, your FICO score may not change much at all. If you’re looking to buy a new car with a loan or get a mortgage, your score may change more significantly.

Lenders are not obliged to report all of your transactions to FICO but most do. It’s in their interest to keep the data as accurate as possible as they use it to assess your creditworthiness. You may find smaller changes do not affect your score at all and that’s normal.

How can you check your FICO score?

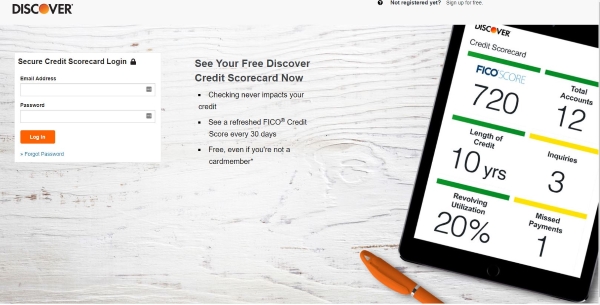

Most of the larger financial institutions work with FICO which is why it is so popular. You can use one of their services to access your score and see your score. The easiest way to check is to use the Discover Credit Scorecard.

The Discover Credit Scorecard is free and you don’t have to be a Discover customer to use it. You fill in the form, answer some questions to verify your identity, including your social security number, and you will get access to your FICO score. Checking your score will not impact it in any way as this is classed as a soft inquiry and both credit scores and FICO scores only record hard inquiries.

How often should you check your FICO score?

There is no hard and fast rule as to how often to check your score. It makes sense to keep an eye on it though. If you’re a high net worth individual, having the score monitored by a financial product may make sense. For the rest of us, checking it before applying for credit, if we suspect something is wrong or we may have been a victim of identity theft are usually the times we check it.

What’s a ‘good’ FICO score?

A ‘good’ FICO score depends on many factors and can be interpreted by different lenders in different ways. There is a broad understanding of the levels though.

- Excellent FICO score = 800 and above

- Very good FICO score = 740-799

- Good FICO score = 670-739

- Fair FICO score = 580-669

- Poor FICO score = 579 and below

As your FICO score is just one aspect of what a lender checks when assessing creditworthiness, having a fair or poor score does not prevent anyone accessing credit. That credit may be more expensive and be offered by a narrower range of lenders but there is still lots of credit out there for all kinds of FICO scores.