Manage Your Finances With EveryDollar

The holidays are just around the corner, and if you’re anything like me, you plan to finish up all your shopping on Christmas Eve. Perfectly logical, right? Maybe not, as far as budgeting finances go.

Typically, my budget—especially of the holiday variety—is a mess. I’ve always enjoyed creating a budget, but keeping track of that budget is always a challenge. I either overspent here, or underspent there. I’m missing 37 cents over there, but now I magically have $5 available over here. It’s very stressful keeping a budget, trying to make sure everything gets paid, and so on. Until about a month ago…

EveryDollar

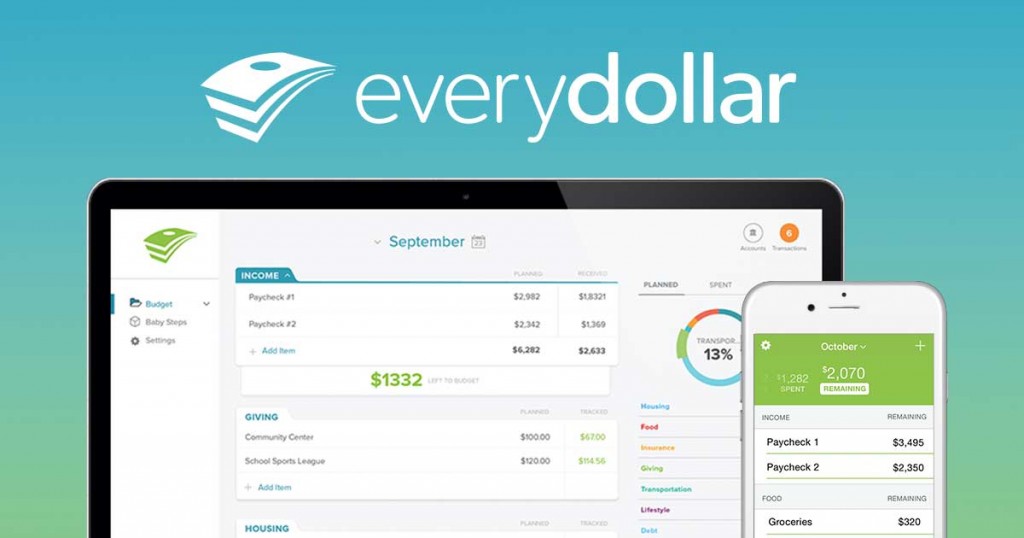

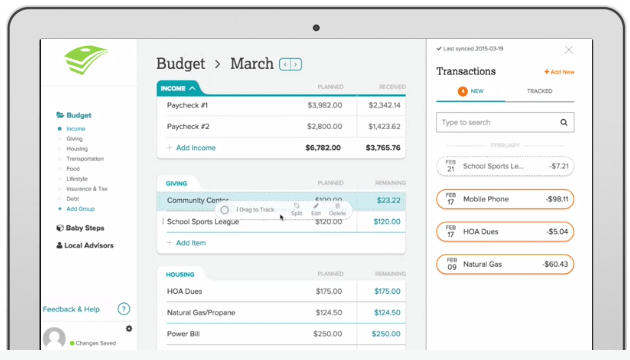

I came across a fairly-new online budgeting tool, called EveryDollar, developed by the Dave Ramsey team. With EveryDollar, you can easily track your income, create budgets, and list your transactions, all with just a few clicks. Not only that, but it has helpful tips for taking back your budget, such as creating an emergency fund and knocking out debts.

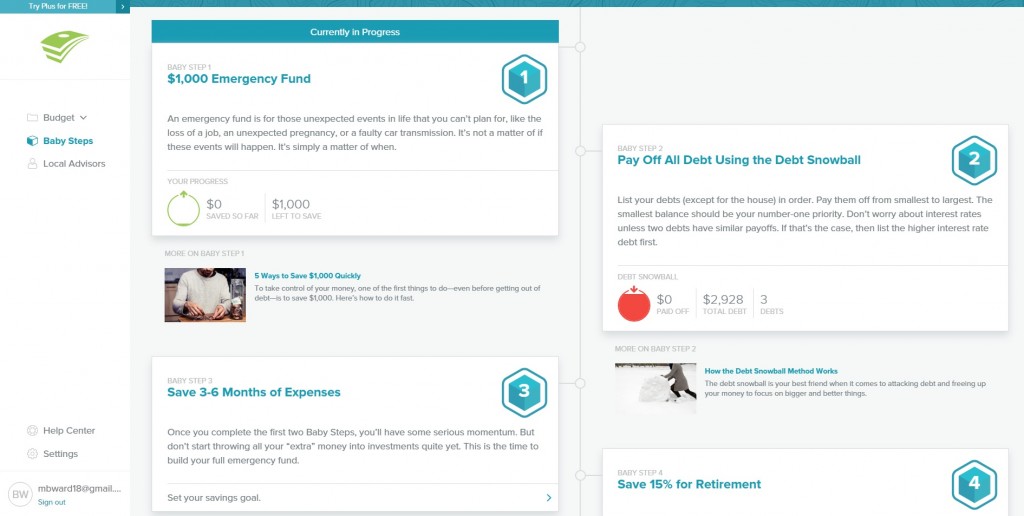

For those that are in debt, EveryDollar’s debt tracking feature is probably one of the best and most robust features. You can list all of your debts in one easy-to-access column, and EveryDollar will help you put them in the proper order to begin paying them off as quickly as possible. Once they’re all paid off, EveryDollar will help you build a 3-6 month Emergency Fund and other securities.

The best thing? Nearly every one of EveryDollar’s features are free. If you want to monitor your online banking through them, then you can upgrade at any time. For me, that’s not necessary, so the free version is perfect.

EveryDollar also has a “Local Advisors” tab, which gets you in contact with Dave Ramsey Endorsed Local Providers (ELPs), which are essentially trustworthy agents. Looking to buy a new home? Then you want someone you can trust, not someone who’s looking to make an extra few hundred dollars off of you. This tab can get you in contact with more than just Real Estate experts, though. The ELPs encompass insurance (life, auto, health, etc) and investing experts as well.

EveryDollar On The Go

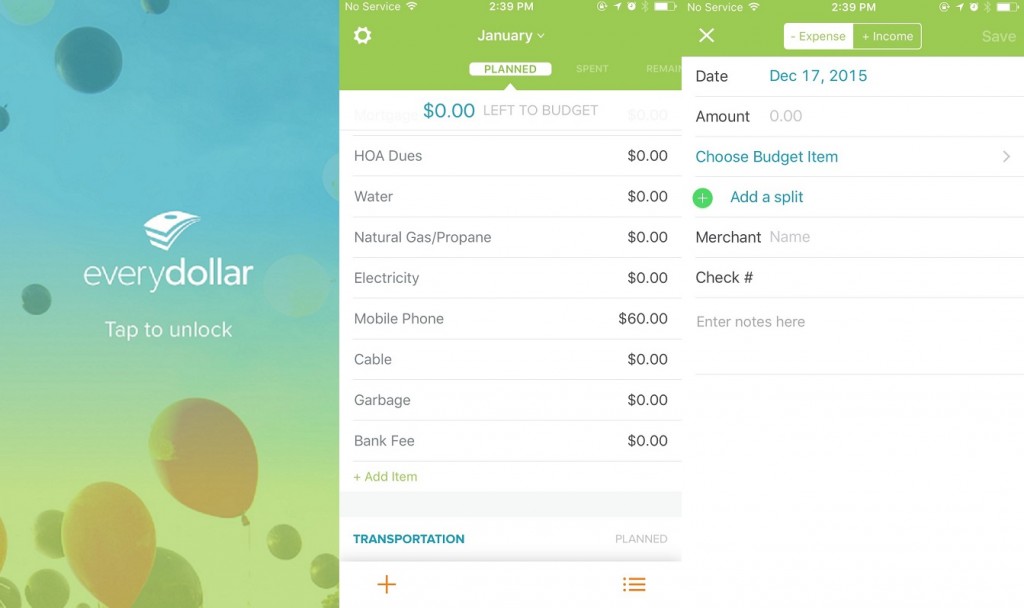

EveryDollar also has an iPhone app, which is the main point I want to touch on. It’s very robust, handy, and efficient. Did you just finish your Christmas shopping? It takes just seconds to punch in your transactions! When is the best time to track your spending? Right after you spend. This app allows you to do just that quickly and easily.

The EveryDollar iPhone app is also extremely secure, using varying levels of encryption to keep your budget locked up tight. Not only that, but EveryDollar understands the frustration of always punching in your password to check on your budget. If you have an iPhone 5S or newer, EveryDollar will let you use Touch ID to enter the app, removing the need to type in that password all the time. It’s convenient and still secure!

In summary, EveryDollar is easy to navigate and fun to use; there are no hidden fees and it does all the math for you! One of the best things EveryDollar does is makes it easy to spend without guilt. Did you budget $100 for restaurants during the month? Listing that in EveryDollar and making room for it in your budget makes spending guilt-free.

The features that EveryDollar has is just like any other budgeting app: you punch in your income as well as your expenses, and you let the app do all the math for you. However, where EveryDollar stands out is that it helps you work towards financial freedom, as mentioned earlier. It gives you a tried and true plan to building a $1,000 emergency fund, paying off all your debts, and saving up 3-6 months in expenses. A guideline to financial freedom isn’t something many other apps offer.

One of the app’s powerful features is the ability to stream your bank transactions into your budget, though you can only access this feature with an EveryDollar Plus subscription at $99/year (less than $10 per month). This feature is well worth signing up for the subscription, as this is where you truly see your spending habits. EveryDollar, once you add these transactions to the proper categories, will show you how quickly spending can get out of control, and thus ruin your budget.

EveryDollar, at its core, is all about financial freedom, which is a guideline many competitors don’t offer.

There is one unfortunate detail: the Android app won’t be released until sometime in 2016.

Closing

I was extremely disappointed to find out that EverDollar’s Android app was not available. It’s easiest to track your spending right away, but if you’re an Android user, you have to wait, which just seems like more of a chore to me. However, the pros still outweigh the cons. This handy tool has helped me to stay on budget this holiday season, and I know it will for you as well!

Money doesn’t have to be stressful. With EveryDollar, I can spend my time on more important things than recalculating, like. . .spending. They do the work, and I get the results. It’s also one of the few services that offers a quality iPhone application. Seems like a good trade to me!