How to Use Google Sheets for Budgeting

When trying to manage your spending, often, what you really need is an excellent tool for budgeting. Sure, there are many great money apps for that, but nothing really beats a carefully crafted spreadsheet.

You can create your own budgeting Google Sheets template if you want to. But the real benefits of using such powerful software is that you can simply pick out one of the templates for creating your budget.

Choose a monthly and an annual template, and the rest is just entering data. This article will cover all you need to know about budgeting with Google Sheets.

How to Find the Budget Template

Using Google Sheets for budgeting has many benefits, but it’s also important to mention that it’s doesn’t cost you anything. And that’s the first step towards successfully managing your budget.

Before we get into all the tips and tricks on how to budget using Google Sheets, let’s see where you can find the template you’ll need.

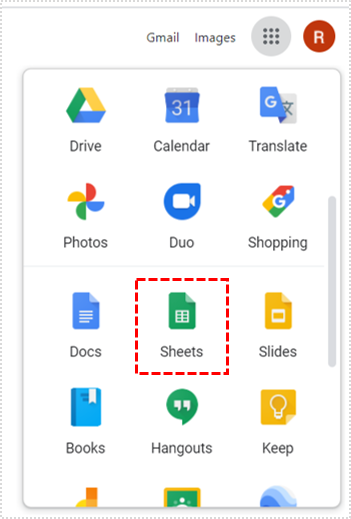

- Open the Google Sheets on your computer.

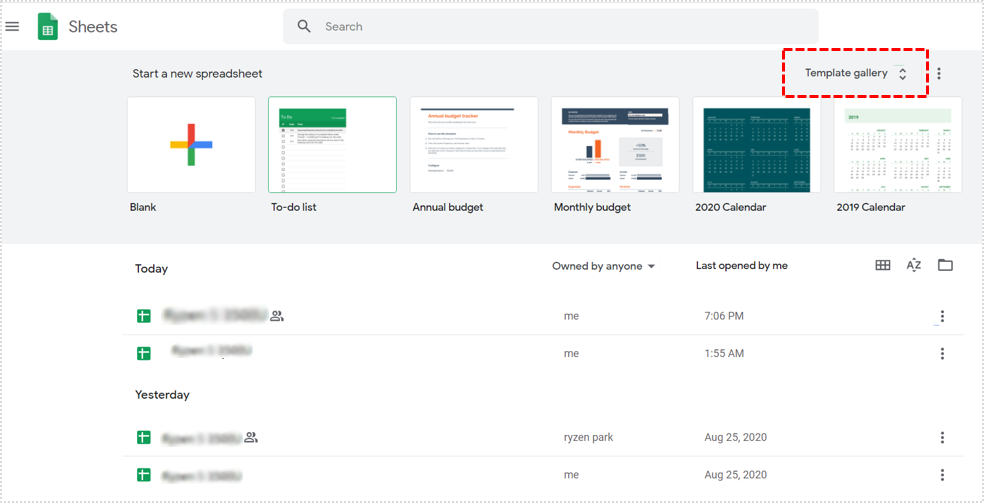

- Click on the “Template gallery”, and the menu will expand with different types of templates.

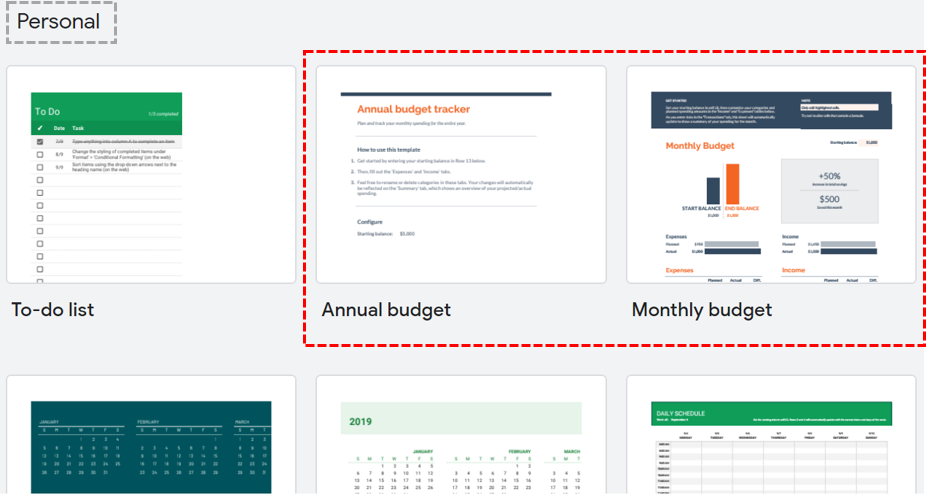

- At the top, under “Personal” you’ll see the option for “Annual budget” and “Monthly budget”.

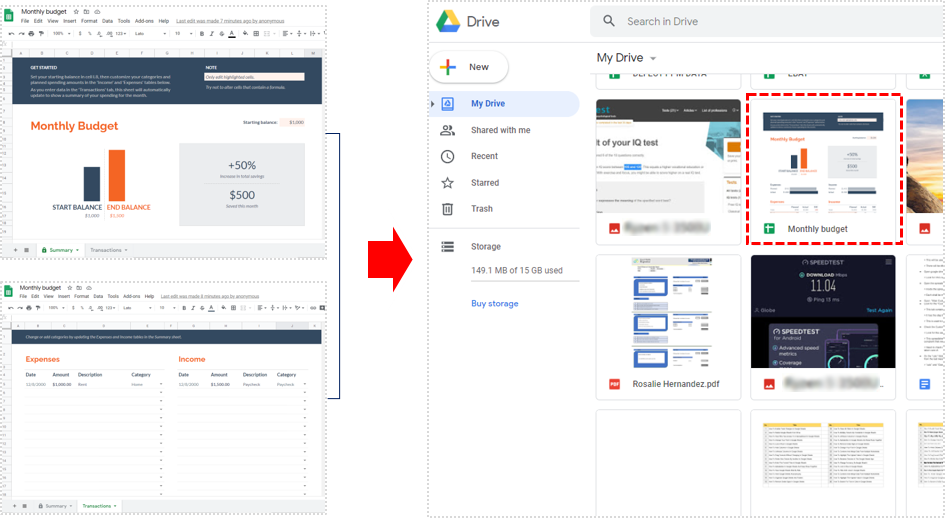

- Select one and it will automatically open and save to your Google Drive.

Customizing the Template

The Google Sheets template for budgeting is just that – a template. It’s up to you to do the rest. The concept and the designs are relatively basic, but they’ll do exactly what’s required of them.

And don’t worry about the limited number of slots per categories. You can quickly expand the rows. You can also rename the categories into anything you want.

And yes, Google Sheets templates will help you manage your money better. But what are some of the essential tips you should keep in mind?

Use the Google Sheets App

This suggestion might seem odd since budgeting seems more convenient on a bigger screen. But having your spreadsheet close to hand has its benefits.

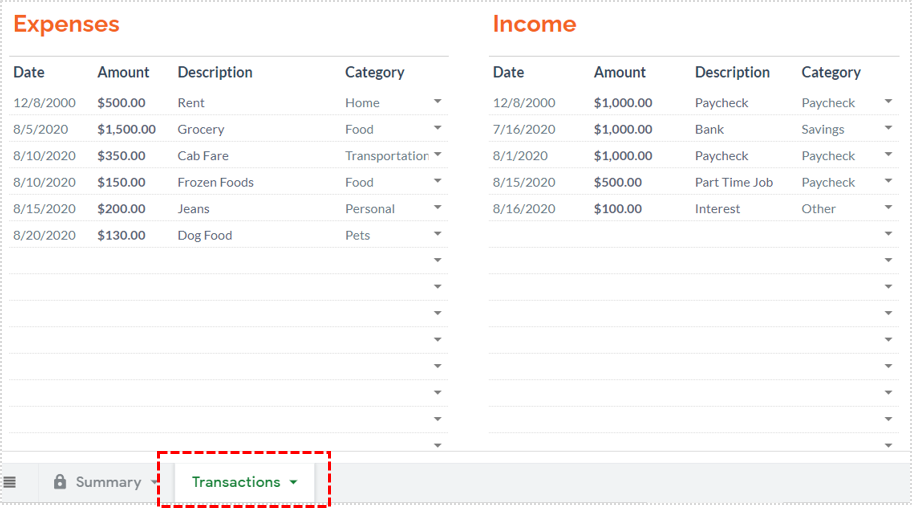

When you buy something, you can immediately make note of it. You can utilize the “Transactions” tab to enter the amount you’ve spent, date, and even put a short description if necessary.

Having to wait until you reach your computer can result in you forgetting the purchase. Just make sure to update either the iOS or Android mobile app regularly.

Work Offline

If you know you’re going to be somewhere without a Wi-Fi access, you can download your budget spreadsheet and work on it while offline. Here’s what you do:

- Open your Google Sheets file and navigate to the toolbar.

- Select “File” and then from the drop-down menu select “Download as”.

- Finally, select the “Microsoft Excel (.xlsx)” option.

Joint Budgeting

Working on your personal expenses is important whether you’re doing it as a family or individually. But if you’re working together with your partner, for example, to organize your finances, Google Sheets makes it easier to communicate.

If you see unexpected expenses under a certain category and want answers as soon as possible, you can leave a comment. Just use the @ in front of your partner’s email address and inquire about the expense in question.

Putting Your Feelings Into the Spreadsheet

Another way to make joint budgeting via Google Sheets more interactive is to add emojis that signify the expense.

A smiley or angry face will show if you approve of a particular purchase or not. And you can add a house emoji to explain that it was something for your home.

Protecting Google Sheets Cells

If you’re worried that you might lose specific data that you’ve spent a lot of time entering, you can lock the cells to make sure no one can edit or erase it.

All you need to do is highlight the cells you want to protect and right-click on them. From the drop-down menu select “Protect range”. This action will prevent any mishaps that might occur.

Better Budgeting with Google Sheets

Most people don’t like going through every expense and transaction. But it’s definitely one of the best ways to gain control over your own finances.

Google Sheets is the number one choice for even the biggest companies in the world when managing their money. And that’s because it keeps things simple yet very organized. Remember, it’s best to use the app so you never miss an entry.

What tool do you use for budgeting? Let us know in the comments section below.